Debts development

Tanzania's National Debt Trends: Examining External and Domestic Debt Dynamics

August 2023, the national debt of this country amounted to USD 40,574.6 million. This debt includes both public and private external debt. The reduction in debt is primarily due to exchange rate fluctuations, particularly the appreciation of the US dollar in comparison to other currencies, and a substantial part of the debt is external in nature, indicating a significant reliance on foreign borrowing.

National Debt Stock:

The national debt stock refers to the total amount of debt that a country owes. This includes various types of debt, such as public debt (both domestic and external) and private external debt. In this case, the national debt stock was USD 40,574.6 million as of the end of August 2023.

Decrease in Debt:

There was a decrease in the national debt stock by USD 728.1 million in comparison to the previous month. This reduction in debt is primarily attributed to exchange rate fluctuations. Exchange rate fluctuations can impact the value of a country's debt when it is denominated in foreign currencies. In this case, it's stated that the appreciation of the US dollar (USD) against other currencies contributed to the decrease in the debt.

Composition of Debt:

The national debt stock is composed of both public and private external debt. Public debt is typically incurred by the government, and it can be further divided into domestic (owed to domestic creditors) and external (owed to foreign creditors) components. In this situation, external debt constituted 70.5 percent of the overall debt. This means that a significant portion of the country's debt is owed to foreign creditors.

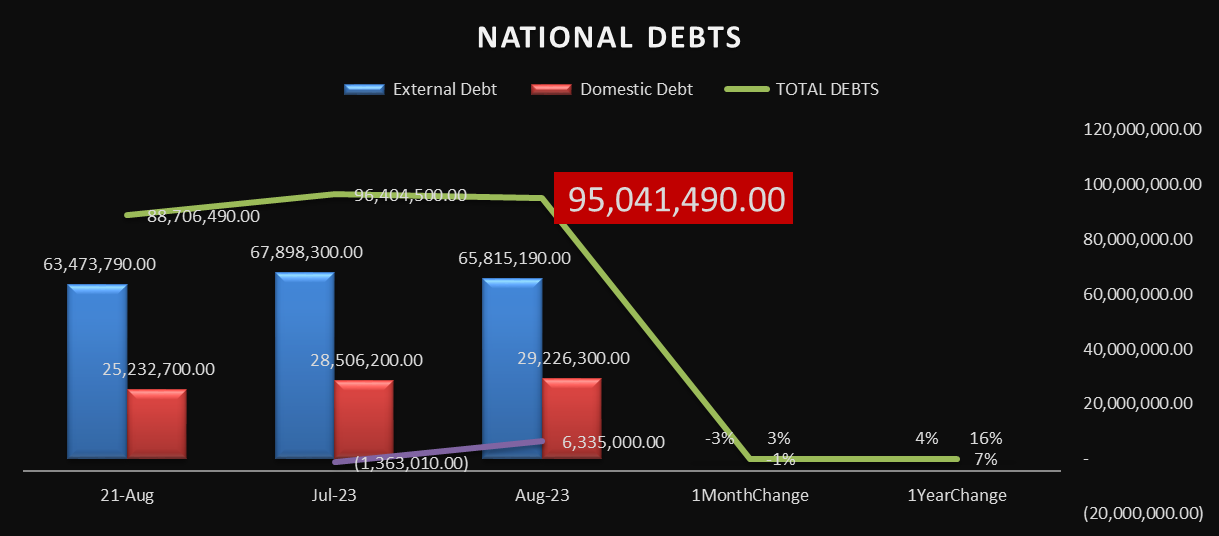

This research provides insights into the changes in a country's national debt over a specific time period. It shows that external debt decreased by 3% in a month but increased by 4% over the year. On the other hand, domestic debt increased by 3% in a month and 16% over the year. The total national debt decreased by 1% in a month but increased by 7% over the year. These numbers reflect the dynamics of the country's external and domestic borrowing and provide valuable information for assessing its fiscal health and economic trends.

The data pertains to the development of a country's national debt as of August 21, July 2023, and August 2023. It includes information about both external debt, domestic debt, and the total debts, along with changes over one month and one year:

External Debt:

Domestic Debt:

Total Debts:

The changes in Tanzania's national debt, both external and domestic, over a specific time period with a complete picture of Tanzania's economic growth.

Debt Composition:

The data shows that both external and domestic debts have increased over the past year. External debt increased by 4%, while domestic debt increased by a substantial 16%. The composition of debt is essential, as it can have different implications for economic growth. High external debt can lead to foreign exchange risks, while high domestic debt can increase the government's interest payment burden.

Total Debt Dynamics:

The total national debt increased by 7% over the past year. An increase in the total debt can be a concern if it outpaces the country's economic growth. It can indicate that the government is borrowing more, which might be used for investments in infrastructure, social programs, or other areas. However, it can also indicate fiscal challenges if the borrowed funds are not used efficiently or if the economy doesn't grow at a rate that can sustain the debt burden.

Short-Term Changes:

The one-month changes in debt levels are relatively small, with a 3% decrease in external debt and a 3% increase in domestic debt. Short-term fluctuations in debt levels can be influenced by various factors, including government policies, borrowing for specific projects, or repayment schedules.

Sustainability:

What's critical in assessing the economic impact of growing national debt is its sustainability. A steadily increasing debt burden can become unsustainable if the country's economic growth doesn't keep pace, leading to fiscal challenges and potential debt crises.