By the end of this section, you will be able to:

The underpinnings of economic growth are investments in physical capital, human capital, and technology, all set in an economic environment where firms and individuals can react to the incentives provided by well-functioning markets and flexible prices. Government borrowing can reduce the financial capital available for private firms to invest in physical capital. But government spending can also encourage certain elements of long-term growth, such as spending on roads or water systems, on education, or on research and development that creates new technology.

A larger budget deficit will increase demand for financial capital. If private saving and the trade balance remain the same, then less financial capital will be available for private investment in physical capital. When government borrowing soaks up available financial capital and leaves less for private investment in physical capital, the result is known as crowding out.

A larger budget deficit will increase demand for financial capital. If private saving and the trade balance remain the same, then less financial capital will be available for private investment in physical capital. When government borrowing soaks up available financial capital and leaves less for private investment in physical capital, the result is known as crowding out.

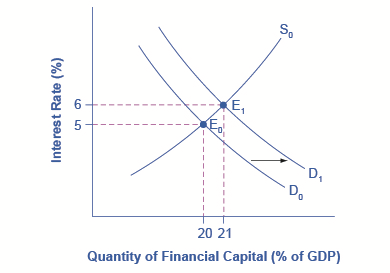

Assume that government borrowing of substantial amounts will have an effect on the quantity of private investment. How will this affect interest rates in financial markets? the original equilibrium (E0) where the demand curve (D0) for financial capital intersects with the supply curve (S0) occurs at an interest rate of 5% and an equilibrium quantity equal to 20% of GDP. However, as the government budget deficit increases, the demand curve for financial capital shifts from D0 to D1. The new equilibrium (E1) occurs at an interest rate of 6% and an equilibrium quantity of 21% of GDP.

Figure 2. Budget Deficits and Interest Rates. In the financial market, an increase in government borrowing can shift the demand curve for financial capital to the right from D0 to D1. As the equilibrium interest rate shifts from E0 to E1, the interest rate rises from 5% to 6% in this example. The higher interest rate is one economic mechanism by which government borrowing can crowd out private investment.

After all, use expansionary monetary policy to reduce interest rates, or in this case, to prevent interest rates from rising? This useful question emphasizes the importance of considering how fiscal and monetary policies work in relation to each other. Imagine a central bank faced with a government that is running large budget deficits, causing a rise in interest rates and crowding out private investment. If the budget deficits are increasing aggregate demand when the economy is already producing near potential GDP, threatening an inflationary increase in price levels, the central bank may react with a contractionary monetary policy. In this situation, the higher interest rates from the government borrowing would be made even higher by contractionary monetary policy, and the government borrowing might crowd out a great deal of private investment.

On the other hand, if the budget deficits are increasing aggregate demand when the economy is producing substantially less than potential GDP, an inflationary increase in the price level is not much of a danger and the central bank might react with expansionary monetary policy. In this situation, higher interest rates from government borrowing would be largely offset by lower interest rates from expansionary monetary policy, and there would be little crowding out of private investment.

However, even a central bank cannot erase the overall message of the national savings and investment identity. If government borrowing rises, then private investment must fall, or private saving must rise, or the trade deficit must fall. By reacting with contractionary or expansionary monetary policy, the central bank can only help to determine which of these outcomes is likely.

Public physical capital investment of this sort can increase the output and productivity of the economy. An economy with reliable roads and electricity will be able to produce more. But it is hard to quantify how much government investment in physical capital will benefit the economy, because government responds to political as well as economic incentives. When a firm makes an investment in physical capital, it is subject to the discipline of the market: If it does not receive a positive return on investment, the firm may lose money or even go out of business.

In some cases, lawmakers make investments in physical capital as a way of spending money in the districts of key politicians. The result may be unnecessary roads or office buildings. Even if a project is useful and necessary, it might be done in a way that is excessively costly, because local contractors who make campaign contributions to politicians appreciate the extra business. On the other hand, governments sometimes do not make the investments they should because a decision to spend on infrastructure does not need to just make economic sense; it must be politically popular as well. Managing public investment so that it is done in a cost-effective way can be difficult.

If a government decides to finance an investment in public physical capital with higher taxes or lower government spending in other areas, it need not worry that it is directly crowding out private investment. Indirectly however, higher household taxes could cut down on the level of private savings available and have a similar effect. If a government decides to finance an investment in public physical capital by borrowing, it may end up increasing the quantity of public physical capital at the cost of crowding out investment in private physical capital, which is more beneficial to the economy would be dependent on the project being considered.

In most countries, the government plays a large role in society’s investment in human capital through the education system. A highly educated and skilled workforce contributes to a higher rate of economic growth. For the low-income nations of the world, additional investment in human capital seems likely to increase productivity and growth. For the United States, tough questions have been raised about how much increases in government spending on education will improve the actual level of education.

Not all spending on educational human capital needs to happen through the government: many college students in the United States pay a substantial share of the cost of their education. If low-income countries of the world are going to experience a widespread increase in their education levels for grade-school children, government spending seems likely to play a substantial role. For the U.S. economy, and for other high-income countries, the primary focus at this time is more on how to get a bigger return from existing spending on education and how to improve the performance of the average high school graduate, rather than dramatic increases in education spending.

Research and development (R&D) efforts are the lifeblood of new technology. According to the National Science Foundation, federal outlays for research, development, and physical plant improvements to various governmental agencies have remained at an average of 8.8% of GDP. About one-fifth should be R&D spending goes to defense and space-oriented research. Although defense-oriented R&D spending may sometimes produce consumer-oriented spinoffs, R&D that is aimed at producing new weapons is less likely to benefit the civilian economy than direct civilian R&D spending.

Fiscal policy can encourage R&D using either direct spending or tax policy. Government could spend more on the R&D that is carried out in government laboratories, as well as expanding federal R&D grants to universities and colleges, nonprofit organizations, and the private sector.

Economic growth comes from a combination of investment in physical capital, human capital, and technology. Government borrowing can crowd out private sector investment in physical capital, but fiscal policy can also increase investment in publicly owned physical capital, human capital (education), and research and development. Possible methods for improving education and society’s investment in human capital include spending more money on teachers and other educational resources, and reorganizing the education system to provide greater incentives for success. Methods for increasing research and development spending to generate new technology include direct government spending on R&D and tax incentives for businesses to conduct additional R&D.