Sparkling Opportunities for Society and Economy

Tanzania ranks among Africa's top ten diamond-producing countries, with a production value of 375,533.14, equivalent to USD 110,936,767.64. The leading producer is Botswana, with a production volume of 24,509,939.00, followed by the Democratic Republic of Congo at 9,908,997.66, South Africa at 9,660,233.0, Angola at 8,763,309.30, Zimbabwe at 4,461,450.15, Namibia at 2,054,227.06, Lesotho at 727,736.95, Sierra Leone at 688,970.20, Tanzania at 375,533.14, and Guinea at 128,770.65.

In 2022, eight African nations secured their esteemed positions within the top ten global diamond-producing countries. This information is sourced from the Kimberley Process.

It's common knowledge that Africa possesses a wealth of valuable minerals essential for economic growth, ranging from substantial oil reserves to fertile agricultural lands. The continent accounts for roughly 30% of the world's total mineral reserves, encompassing resources such as gold, copper, platinum, cobalt, uranium, lithium, and more, which play pivotal roles across various industries, from electronics and infrastructure to energy production.

What's intriguing is that these mineral riches are not concentrated in a specific region but are dispersed across the continent, significantly contributing to the economic development of numerous African nations. Amidst this abundance of resources, diamonds emerge as highly sought-after treasures. The continent is home to several of the world's most prolific diamond-producing countries, each with its unique story in the global diamond industry.

Recent diamond production statistics from the Kimberley Process, a collaborative initiative involving governments, industries, and civil society to regulate the diamond trade and production, underscore the prominent role played by African nations in the global diamond industry. Globally, only 22 countries are engaged in rough diamond production, also known as uncut, raw, or natural diamonds, extracted from deposits within their borders. Remarkably, in 2022, eight African nations secured their esteemed positions within the top ten global diamond-producing countries.

Diamond production can bring significant benefits, it also comes with challenges, including environmental concerns, the need for transparent and accountable governance, and ensuring that the benefits reach the wider population. Careful management of the diamond industry is crucial to maximize the social and economic advantages for Tanzania:

Economic Growth:

High diamond production contributes significantly to the country's GDP. The revenue generated from diamond exports can be used for infrastructure development, public services, and various developmental projects, thereby promoting economic growth.

Job Creation:

The diamond industry provides employment opportunities for many Tanzanians, both directly in mining and processing and indirectly in support services, such as logistics, security, and retail. This helps reduce unemployment and poverty levels.

Foreign Exchange Earnings:

Diamond exports bring in foreign currency, which can stabilize Tanzania's balance of payments. This, in turn, can support the stability of the Tanzanian Shilling and ensure the country's capacity to import goods and services.

Infrastructure Development:

Revenue generated from diamond production can be reinvested in improving infrastructure, such as roads, schools, hospitals, and utilities. This not only benefits the mining regions but also has a positive ripple effect on the entire country.

Skill Development:

The diamond industry requires a skilled workforce, leading to skill development and capacity building. This can enhance the overall employability of the Tanzanian workforce.

Social Programs:

The government can use diamond revenue to fund social programs, including healthcare, education, and poverty alleviation initiatives, which can improve the overall well-being of the population.

Attracting Foreign Investment:

A thriving diamond industry can attract foreign investment, which can lead to technology transfer, increased productivity, and further economic development.

Regional Development:

Diamonds are often mined in rural or less-developed regions. The industry can stimulate the growth of these areas, providing access to basic amenities and improving the quality of life for local communities.

Infrastructure for Mining:

The presence of a robust diamond mining sector can lead to the development of infrastructure such as roads, electricity, and transportation networks, which can benefit both the diamond industry and other sectors of the economy.

Promotion of Sustainable Practices:

The revenue generated from diamonds can be used to invest in sustainable and responsible mining practices, minimizing the environmental impact and ensuring long-term viability of the industry.

Here are the top 10 diamond-producing countries in Africa:

| Rank | Country | Production volume | Value ($) |

| 1 | Botswana | 24,509,939.00 | $4,700,321,539.00 |

| 2 | Democratic Republic of Congo | 9,908,997.66 | $64,959,638.25 |

| 3 | South Africa | 9,660,233.00 | $1,538,930,037.97 |

| 4 | Angola | 8,763,309.30 | $1,965,247,499.47 |

| 5 | Zimbabwe | 4,461,450.15 | $423,612,395.43 |

| 6 | Namibia | 2,054,227.06 | $1,234,496,934.12 |

| 7 | Lesotho | 727,736.95 | $314,358,893.67 |

| 8 | Sierra Leone | 688,970.20 | $142,907,210.45 |

| 9 | Tanzania | 375,533.14 | $110,936,767.64 |

| 10 | Guinea | 128,770.65 | $6,556,170.10 |

Key Strategies for Growth and Security

Tanzania does not rank among the top 10 African countries with the largest pension assets, as per the Absa Africa Financial Markets Index for 2023. The ability to foster local investment is closely tied to the strength of a country's pension assets, a key observation highlighted in the 2023 Financial Market Report by Absa.

The term "large pension assets" denotes a substantial pool of financial resources held within pension funds or retirement savings accounts. These resources are earmarked and invested to ensure financial security and income for individuals during their retirement years.

In Absa's 2023 Africa Financial Markets report, the measurement of local investor capacity is one of the six fundamental pillars used to assess the most thriving financial markets throughout Africa. This specific pillar concentrates on local investor capacity by evaluating the growth of pension systems. According to the report, pension funds possess the potential to drive the development of capital markets due to their extended investment horizons and their ability to diversify across a wide array of asset classes, including listed equities, corporate bonds, and private markets.

The report further elaborates that this pillar relies on two main components: the assessment of pension fund assets per capita to gauge their size and their comparison to domestically listed securities to assess their contribution to local capital markets.

The absence of substantial pension assets in Tanzania has a direct impact on the country's ability to invest locally, develop its capital markets, ensure retirement security, and support infrastructure development. Addressing these issues by strengthening the pension system can contribute to the country's long-term economic well-being and prosperity.

Limited Local Investment:

With inadequate pension assets, Tanzania's ability to invest locally is constrained. A significant portion of pension funds from other countries can be invested in local infrastructure projects, businesses, and financial markets, contributing to economic growth and job creation.

Reduced Capital Market Development:

Robust pension assets play a crucial role in developing a nation's capital markets. These assets provide stability and liquidity, attracting more investors and fostering the growth of financial markets. Tanzania's limited pension assets mean it's missing the opportunity to build a thriving capital market, which is essential for long-term economic stability.

Retirement Security:

Inadequate pension assets can result in limited retirement security for the country's aging population. Without substantial pension savings, retirees may struggle to maintain their standard of living, increasing the burden on social safety nets and potentially leading to financial insecurity among the elderly.

Limited Infrastructure Investment:

Pension funds often invest in long-term infrastructure projects, such as roads, bridges, and energy facilities. Tanzania's lack of significant pension assets means less funding available for such projects, which are crucial for the country's development and economic competitiveness.

Missed Diversification Opportunities:

Pension assets can serve as a source of diversification in the investment portfolio. Insufficient pension assets limit the ability to invest in a broad range of asset classes, potentially missing out on opportunities for higher returns and risk management.

Reduced Economic Growth:

A robust pension system can contribute to economic growth by channeling savings into productive investments. Tanzania's limited pension assets mean less capital available for productive investments, hindering economic growth and development.

Reform and Strengthen Pension Legislation:

Tanzania should focus on revising and enhancing pension laws and regulations to provide a robust legal framework for pension funds. This includes defining contribution rates, eligibility, and ensuring compliance with international best practices.

Encourage Private Pension Participation:

Promote the growth of private pension schemes, allowing individuals and employers to contribute to retirement savings beyond government systems. Incentives and tax breaks can be introduced to encourage participation.

Increase Financial Literacy:

Improve financial literacy among the population to raise awareness about the importance of saving for retirement. Financial education programs can empower individuals to make informed decisions about their pension contributions and investments.

Diversify Investment Options:

Allow pension funds to invest in a broader range of asset classes, including equities, bonds, and alternative investments. Diversification can potentially yield higher returns and reduce risk.

Enhance Governance and Transparency:

Implement strong governance and transparency standards within the pension industry to build trust among participants and investors. Robust oversight can prevent mismanagement and fraud.

Promote Employer-Sponsored Plans:

Encourage employers to establish pension plans for their employees. Mandatory or voluntary employer-sponsored plans can significantly increase the coverage and contributions to pension funds.

Introduce Auto-Enrollment:

Consider implementing auto-enrollment systems, where employees are automatically enrolled in pension plans, but they have the option to opt out if they choose. This can boost participation rates.

Long-Term Investment Focus:

Encourage a long-term investment approach by pension funds. Regulations can be designed to discourage short-term thinking and promote investments in infrastructure and other long-term projects.

Public Awareness Campaigns:

Launch public awareness campaigns to educate citizens about the benefits of pension savings and the potential consequences of not saving for retirement.

Collaborate with Financial Institutions:

Partner with financial institutions to provide pension products and services that cater to various income levels, making pension participation accessible to a broader segment of the population.

Regular Monitoring and Evaluation:

Continuously monitor and evaluate the performance of pension funds and the effectiveness of pension policies, making adjustments as necessary to ensure growth and sustainability.

Government Contributions:

Explore the possibility of government contributions to pension funds, particularly for low-income individuals who may struggle to make adequate contributions themselves.

DP World's $250 Million Investment in Tanzania's Port Infrastructure

Dubai has secured a 30-year agreement with Tanzania to oversee a portion of the Dar es Salaam port, the largest in the country. This deal, despite facing previous opposition from Tanzanian opposition groups and human rights organizations, will see DP World, a state-owned Dubai-based ports operator, take on the lease and operational responsibilities for four of the port's 12 berths.

The port of Dar es Salaam plays a vital role in serving landlocked nations in East and Southern Africa, such as Uganda, Rwanda, Burundi, and Zambia, which is a significant copper producer. According to the Director General of the state-owned Tanzania Ports Authority (TPA), DP World will operate berths four to seven. The Tanzanian government has also been actively seeking other investors to manage berths eight through eleven. The contract with DP World has a 30-year term, with performance evaluations every five years.

The collaboration with DP World aims to enhance the port's efficiency by reducing cargo clearance times and increasing its capacity to accommodate 130 vessels per month, a notable improvement from the current capacity of 90 vessels. During the signing ceremony in Dodoma, DP World's Chairman and Chief Executive, Sultan Ahmed Bin Sulayem, pledged a $250 million investment over the next five years. This investment will primarily focus on upgrading the port's infrastructure, particularly in improving cargo clearing systems and eliminating delays to streamline port operations.

While the Tanzanian parliament endorsed the bilateral agreement between Tanzania and Dubai back in June, it encountered opposition from various quarters, including the Catholic church, legal professionals, activists, and opposition parties, who believed the terms favored DP World and provided limited benefits to Tanzania. In response to these concerns, President Samia Suluhu Hassan emphasized that her administration had considered all perspectives and feedback during the negotiation process with DP World.

Social Impacts:

Economic Impacts:

It's important to note that while this agreement is expected to bring many benefits, it may also have challenges and potential downsides, such as concerns about the terms of the agreement and its impact on local businesses. The social and economic impacts will depend on how well the partnership is managed and how effectively it addresses the needs and interests of the Tanzanian people and economy.

Social Impacts:

Tanzania's 30-year port agreement with DP World carries several potential negative social consequences. Firstly, while the partnership is expected to bring job opportunities, it may also lead to job displacement, particularly if DP World introduces automation or brings in its own workforce. Additionally, the widespread opposition to the agreement, coming from political opposition, activists, and religious institutions like the Catholic church, raises concerns about social discontent and the potential for protests that could disrupt social stability. Infrastructure expansion tied to the agreement may also result in the displacement of local communities, exacerbating social upheaval and community disruptions.

Economic Impacts:

From an economic perspective, the long-term port agreement with DP World could have unfavorable terms that raise concerns about equity, potentially favoring DP World over Tanzania. This could lead to economic imbalances and an unequal distribution of benefits. If the agreement does not prioritize local businesses and suppliers, it may limit the economic advantages that Tanzania can derive from the partnership, impacting local economic growth and development. The agreement may also entail financial risks, possibly increasing Tanzania's debt burden if not managed effectively, diverting vital resources away from other critical sectors. There's a risk of dependence on external expertise and resources due to this partnership, which may pose economic vulnerabilities, and it may result in reduced control over the port's operations, potentially hampering Tanzania's ability to tailor the port's activities to its specific economic needs. Nonetheless, the degree of these negative impacts can be mitigated through careful negotiation, rigorous oversight, and effective governance, and the ultimate success of the partnership hinges on addressing these challenges while maximizing positive social and economic outcomes.

A Look at its 15% Share in Sub-Saharan Africa

Tanzania has emerged as one of the top 10 countries for prospective investments in sub-Saharan Africa, according to a report by KPMG. Leading the pack is South Africa, commanding a significant 50% share, followed by Nigeria at 30%, and Tanzania securing a notable 15%. Further down the list are Ghana, Kenya, and Mauritius, each capturing 14%, with Zambia closely trailing at 11%.

In the course of several years, sub-Saharan Africa has consistently presented itself as a region brimming with potential and opportunities, particularly appealing to astute investors. Abundant natural resources, a burgeoning consumer base, and a youthful workforce have rendered numerous countries within this region as alluring destinations for those keen on participating in the unfolding economic growth narrative.

A recent KPMG report, "Doing Deals in Sub-Saharan Africa," underscores South Africa's prominence in the realm of mergers and acquisitions. South Africa takes the lead, accounting for five of the top ten mega deals in the region. Meanwhile, Nigeria boasts two such deals, while Tanzania, Cameroon, and Angola each secure one position within the top ten rankings.

KPMG's survey further reveals that a substantial 50% of prospective investors are looking towards South Africa, with approximately 30% expressing their interest in engaging in business ventures within Nigeria.

Here is the list of the top 10 African countries to keep an eye on for future investments in sub-Saharan Africa:

| Rank | Country | Percentage |

| 1 | South Africa | 50% |

| 2 | Nigeria | 30% |

| 3 | Tanzania | 15% |

| 4 | Ghana | 14% |

| 5 | Kenya | 14% |

| 6 | Mauritius | 14% |

| 7 | Zambia | 11% |

| 8 | Uganda | 10% |

| 9 | Mozambique | 6% |

| 10 | Zimbabwe | 6% |

Tanzania is perceived as a country with a positive investment climate and opportunities for growth, making it one of the top choices for prospective investors in sub-Saharan Africa:

Tanzania's Rank:

Tanzania is ranked third among the top 10 countries for future investments in sub-Saharan Africa, with a 15% share.

Positive Investment Outlook:

The fact that Tanzania is included in the list of top 10 countries for future investments indicates that it is considered an attractive destination for potential investors. It suggests that Tanzania has a favorable business environment and potential opportunities for investors.

Steady Investment Share:

Although Tanzania's percentage (15%) is lower than South Africa (50%) and Nigeria (30%), it still holds a significant share, which demonstrates a consistent and notable interest from investors.

Investment Potential:

The inclusion of Tanzania in this list highlights its investment potential and suggests that it has qualities that make it a promising market for future investments, making it an appealing prospect for investors looking to participate in the region's economic growth.

Holding the 10th Spot in African Financial Market Rankings

Tanzania stands among the ten African nations with the most vibrant financial markets, ranked tenth in this regard, following South Africa, Mauritius, Nigeria, Uganda, Namibia, Botswana, Kenya, Morocco, and Ghana. This ranking is sourced from the Absa Africa Financial Markets report. The indices listed are derived from the amalgamation of scores from six key economic indicators.

Africa possesses one of the world's most diverse and expansive financial markets. The continent showcases a spectrum of fiscal and economic realities, offering distinct financial securities depending on regional variations. Africa's status as a developing economy, coupled with its rapid adoption of technology, rich mineral resources, and a youthful demographic, makes it an attractive destination for capital investment. This environment ensures the flourishing of nearly any imaginable industry, thereby generating stocks, bonds, and essential raw materials to bolster a thriving economy.

However, a country's financial market performance hinges significantly on factors such as market accessibility, openness, and transparency measures. Utilizing these metrics, Absa Group Limited, formerly known as Amalgamated Banks of South Africa until 2005 and Barclays Africa Group Limited, assessed the African countries with the most prosperous financial markets. The group's objective is to demonstrate how economies can dismantle barriers to investment and promote sustainable growth through their study, the Absa Africa Financial Markets.

Assisted by the United Nations Economic Commission, this year's report for Africa includes 28 nations, including Cabo Verde and Tunisia. Absa gauged Africa's financial market performance based on six economic pillars: market depth, access to foreign exchange, market transparency, tax and regulatory environment, local investor capacity, macroeconomic conditions, and transparency, legal standards, and enforceability. The scores for each pillar are derived from the relative performance of each country for each indicator, subsequently recalibrated to create a uniform scale. The overall results are computed as an average of the scores across all pillars.

Tanzania's financial market performance is relatively stable and falls within the top 10 in Africa, with a moderate index value:

Consistent Ranking:

Tanzania is ranked as the 10th African nation in terms of financial market performance for both 2023 and 2022. This suggests that its financial market performance remained relatively stable over this one-year period.

Index Value:

Tanzania's financial market performance is quantified by an index of 55 for both 2023 and 2022. While this index places Tanzania in the lower half of the top 10, it indicates a moderate level of financial market development.

Stability:

The consistent index value between 2023 and 2022 suggests that Tanzania's financial market did not experience significant fluctuations or drastic changes in performance during this period.

Relative Position:

While Tanzania may not be in the top tier of African countries for financial market performance, it still holds a position among the top 10. This indicates that its financial markets are relatively competitive and offer opportunities for investment and economic activity within the African context.

| Rank | Country | 2023 Index | 2022 Index |

| 1 | South Africa | 88 | 89 |

| 2 | Mauritius | 77 | 77 |

| 3 | Nigeria | 67 | 68 |

| 4 | Uganda | 63 | 64 |

| 5 | Namibia | 63 | 63 |

| 6 | Botswana | 59 | 58 |

| 7 | Kenya | 59 | 60 |

| 8 | Morocco | 58 | 57 |

| 9 | Ghana | 58 | 59 |

| 10 | Tanzania | 55 | 55 |

The research data pertains to various financial transactions and activities in Tanzania's financial sector, specifically related to cash deposits, cash withdrawals, and agent banking transactions:

Cash Deposits:

Cash Withdrawals:

Agent Banking Transactions:

Number of Agents:

Volume and Value:

The presence of large banks in these channels and the concentration of services in urban areas underscore the role of these channels in expanding financial inclusion and accessibility to a broader population.

The distribution channels for banking services in Tanzania and how these channels are contributing to financial inclusion:

Distribution Channels for Banking Services:

Increase in Number and Usage of Channels:

Branch Network Overview:

Agent Banking Growth:

Large Banks in Agent Banking:

Urban Concentration in Agent Banking:

Agent banking is becoming an increasingly important component of the financial sector in Tanzania, and it is playing a significant role in enhancing financial inclusion by reaching underserved and remote areas. The active participation of large banks and the growth in transactions and agent numbers indicate a positive performance trend in the financial sector, especially in the realm of agent banking services. This expansion of agent banking is likely contributing to increased access to financial services and ultimately fostering economic growth and development in Tanzania.

Growth in Agent Banking:

The fact that agent banking business has been steadily growing in terms of the number of agents, transactions, and the value of deposit and withdrawal transactions is a positive sign. It shows that agent banking services are gaining popularity and acceptance among the population.

Dominance of Large Banks:

The data shows that large banks play a significant role in the agent banking sector, accounting for a substantial portion (59.7 percent) of the market. This indicates that established financial institutions are actively participating in expanding agent banking services, which can contribute to the sector's stability and growth.

Urban Concentration:

The concentration of agent banking services in urban centers (56.5 percent of total operating bank agents) implies that these services are more accessible and widely available in cities and towns. This urban concentration can be seen as a reflection of higher demand in these areas, potentially due to the convenience factor.

| Cash Deposit | Cash Withdrawals | ||||

| Agent Banking Transactions | Number of Agents | Valume | Value in TZS Billion | Volume | Value in TZS Billion |

| 2022 | 75238 | 81007984 | 61915.9 | 46935798 | 19200.3 |

| 2021 | 48923 | 50942662 | 36179.4 | 30706146 | 10779.6 |

| Growth(Percent) | 53.8 | 59 | 71.1 | 52.9 | 78.1 |

This research shows that the financial sector in Tanzania is performing well in terms of stability, asset quality, profitability, credit growth, regulatory oversight, and efforts to expand financial inclusion. These are positive signs for the overall health and development of the sector and, by extension, the national economy.

Sector Composition:

The financial sector in Tanzania comprises banking, microfinance, insurance, capital markets, and social security sub-sectors, with banking dominating, accounting for over 70% of assets.

| Tanzania Banks Categories | 2022 | 2021 | 2020 | 2019 | 2018 |

| Commercial Banks | 34 | 34 | 35 | 38 | 40 |

| Development Banks | 2 | 2 | 2 | 2 | 2 |

| Microfinance Banks | 4 | 5 | 4 | 5 | 5 |

| Community Banks | 5 | 5 | 5 | 6 | 6 |

Asset Quality Improvement:

Non-performing loans (NPLs) decreased from 8.5% to 5.8% due to better credit risk management practices and measures taken by the Bank.

Liquidity and Profitability:

Liquidity ratios exceeded regulatory requirements, although a decrease was attributed to shifts to more profitable investments. Profitability improved, with higher return on assets and equity driven by increased interest income, non-interest income, and operational efficiency.

Foreign Exchange Risk:

Banks reduced their exposure to foreign exchange risk, with the net open position to core capital decreasing from 7.8% to 2.5%.

Growth in Total Assets:

Total assets increased by 17.3% primarily due to higher deposits, borrowings, and retained earnings. Public confidence in the sector, economic activities, and deposit strategies contributed to deposit growth.

Credit Growth:

Loans, advances, and overdrafts increased by 25.3%, driven by a favorable macroeconomic environment, monetary policy, and regulatory measures supporting private sector credit growth.

Expanded Outreach:

The sector expanded through branch networks, agent banking, and digital channels, improving access and usage of banking services.

Regulatory Changes:

The Bank approved acquisitions and license changes, with one microfinance bank being placed under statutory administration and its assets and liabilities transferred to another bank as a resolution option.

Credit Reference System:

The credit reference system improved, with more credit inquiries and reports sold, helping reduce information asymmetry in credit underwriting processes.

Foreign Exchange Services:

Banks and bureaux de change continued to offer foreign currency services, with the Bank strengthening supervision to ensure compliance with legal and regulatory requirements.

Tanzania's Employment Landscape: A Closer Look at Employment and Labor Dependency

This research provided information on employment rates in Africa, global labor market conditions, and a list of the top ten African countries with the highest employment rates as per the International Labour Organization (ILO):

Tanzania's Employment Rate:

Tanzania is one of the top ten countries in Africa with a high employment rate. Specifically, Tanzania has an employment-to-population ratio of 80.3%, as reported by the International Labour Organization.

Global Population Growth:

According to the United Nations, the global population has reached 8 billion. Sub-Saharan African nations are significant contributors to this population growth, which is a notable factor in the demand for employment.

Employment Challenges in Africa:

The increasing population in Africa is leading to a higher demand for jobs. However, the challenge is that the rate of population growth in Africa is outpacing the creation of new job opportunities. This situation is not unique to Africa and is a global concern.

Global Labor Market Deterioration:

In 2022, the global outlook for labor markets faced significant deterioration, according to the International Labour Organization. Factors contributing to this include emerging geopolitical tensions, the Ukraine conflict, uneven recovery from the pandemic, and supply chain bottlenecks, which have created conditions conducive to stagflation.

Impact of COVID-19:

Most countries worldwide had not yet fully recovered in terms of employment levels and hours worked by 2022, as compared to the pre-pandemic situation in 2019.

African Progress in Employment:

Despite these challenges, some African countries have made commendable progress in addressing employment issues, indicating their commitment to achieving sustainable economic growth and social development.

Importance of Employment Statistics:

The ILO emphasizes the significance of such employment statistics in tracking progress towards both national and international policy objectives.

These statistics provide valuable insights into the employment and dependency dynamics in these African countries. Countries with higher employment rates are better equipped to support their populations, but labor dependency ratios indicate the economic burden of supporting dependents, including children and the elderly, for each employed individual.

Madagascar:

Tanzania:

Burundi:

Ethiopia:

Mozambique:

Liberia:

Niger:

Eritrea:

Kenya:

Angola:

Tanzania's employment rates and labor dependency ratios and its potential implications for economic growth:

High Employment Rate in Tanzania:

Tanzania boasts an employment-to-population ratio of 80.3%, which is relatively high. This indicates that a significant portion of the working-age population in Tanzania is employed. A high employment rate is generally positive as it means that more people are participating in the labor force and contributing to economic activities.

Moderate Labor Dependency Ratio:

Tanzania's labor dependency ratio stands at 1.20. This ratio suggests that, on average, there are 1.20 dependents (children, elderly, and others) for each working individual. While this ratio is not exceptionally low, it is moderate and manageable, indicating that the burden of supporting dependents is within reasonable limits.

Implications for Economic Growth:

The combination of a high employment rate and a moderate labor dependency ratio can have several implications for economic growth in Tanzania:

According to the International Labor Organization, below are 10 African countries with the highest employment rate.

| Rank | Country | Employment to population ratio | Labor dependency ratio |

| 1 | Madagascar | 84.1% | 0.35 |

| 2 | Tanzania | 80.3% | 1.20 |

| 3 | Burundi | 78.9% | 1.34 |

| 4 | Ethiopia | 77.3% | 1.14 |

| 5 | Mozambique | 75.4% | 1.35 |

| 6 | Liberia | 73.8% | 1.28 |

| 7 | Niger | 73.1% | 1.68 |

| 8 | Eritrea | 72.5% | 1.27 |

| 9 | Kenya | 70.3% | 1.29 |

| 10 | Angola | 69.0% | 1.63 |

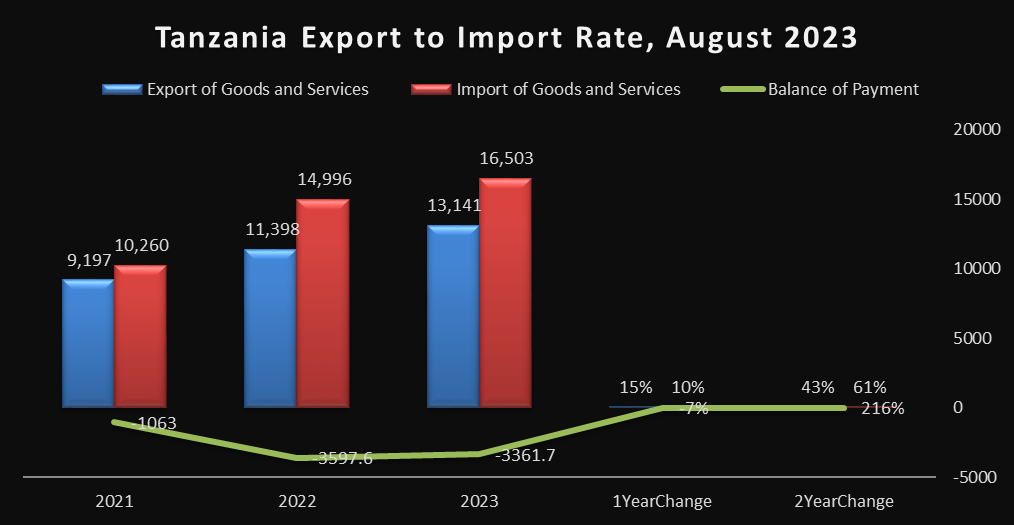

Export and Import Trends (2021-2023)

This research provided pertains to Tanzania's export and import statistics for the year 2021, 2022, and an estimate for 2023, along with the percentage change in these values over the past two years:

Export of Goods and Services:

Import of Goods and Services:

Balance of Payment:

While there is strong growth in both exports and imports, the faster growth in imports has led to a widening trade deficit. The improvement in the balance of payment from 2022 to 2023 shows efforts to address this imbalance.

Overall, the economic performance of Tanzania, as indicated by this research, highlights the importance of managing trade imbalances to ensure long-term economic stability and sustainability:

Export Growth:

Tanzania has experienced consistent growth in its exports of goods and services over the period from 2021 to the projected 2023. The 43% increase over this two-year span shows that the country has been successful in expanding its export activities. This growth can be an indicator of economic vitality, as it reflects the country's ability to produce and sell more goods and services to international markets.

Import Growth:

Imports have also grown significantly, with a 61% increase from 2021 to the estimated 2023 figures. While import growth can indicate economic activity and development, a substantially higher import growth rate compared to exports can lead to trade imbalances and potentially strain the balance of payments.

Trade Deficit:

The balance of payment data indicates that Tanzania has been running a trade deficit. This means that the value of goods and services imported exceeds the value of those exported. A trade deficit can have implications for a country's economic performance, as it implies that it is spending more on imports than it is earning from exports. While a trade deficit is not necessarily negative, it can become a concern if it is consistently widening.

Change in Balance of Payment:

The data shows that the balance of payment has improved slightly in 2023, with a 7% reduction in the negative balance compared to 2022. This could be seen as a positive sign, showing that Tanzania is working towards reducing the trade deficit, which is often a goal for policymakers.

Impact of Monetary Contraction on Tanzania's Economy: Analyzes the decline in net domestic assets, domestic claims, and various money supply measures and its potential effects on economic activity.

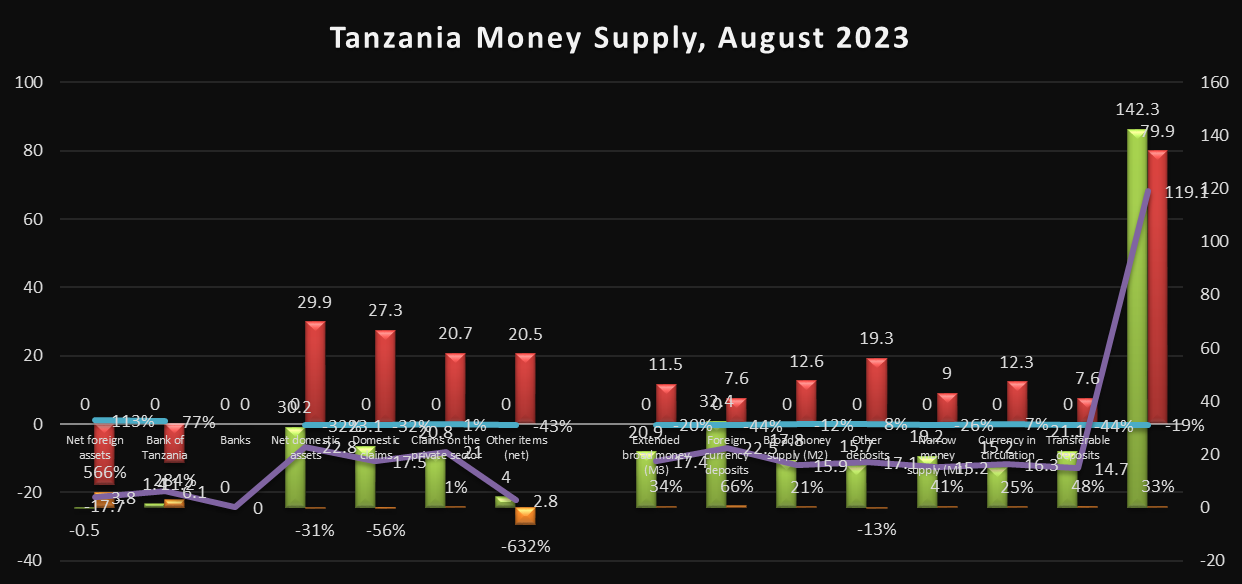

In August 2023, the money supply in Tanzania exhibited various changes and trends. This research is categorized into different components, including net foreign assets, net domestic assets, and different measures of broad and narrow money supply:

Net Foreign Assets:

Bank of Tanzania:

Net Domestic Assets:

Domestic Claims:

Claims on the Private Sector:

Extended Broad Money (M3):

Foreign Currency Deposits:

Broad Money Supply (M2):

Other Deposits:

Narrow Money Supply (M1):

Currency in Circulation:

Transferable Deposits:

The contraction in various money supply measures may raise concerns about economic activity in the short term. However, the increase in net foreign assets and central bank assets shows efforts to stabilize or stimulate the economy, which can be important for long-term economic growth:

Net Foreign Assets:

The significant increase in net foreign assets, both in the one-month and one-year comparisons, indicates a substantial influx of foreign currency into the country. This could be due to factors such as foreign investments, trade balances, or financial inflows. An increase in net foreign assets is generally seen as a positive sign for economic stability.

Bank of Tanzania Assets:

The substantial growth in the assets of the central bank (Bank of Tanzania) is indicative of its monetary policy interventions. It shows that the central bank may be actively managing monetary policy to stabilize or stimulate the economy, which can be a response to economic conditions and goals.

Net Domestic Assets and Domestic Claims:

The decline in net domestic assets and domestic claims indicates a reduction in the money supply generated within the country. A decrease in these figures can be interpreted as a contraction in domestic lending and money creation. This might be an attempt to control inflation or address other monetary concerns.

Claims on the Private Sector:

The slight increase in claims on the private sector can show that banks are willing to extend credit to businesses, potentially supporting economic activity and growth.

Extended Broad Money (M3):

The decrease in the extended broad money supply (M3) shows that the overall money supply in the economy has contracted in the short term. This can have implications for economic growth as a decrease in the money supply may lead to reduced spending and investment.

Foreign Currency Deposits:

The sharp decline in foreign currency deposits may indicate reduced confidence in holding foreign currency or other factors impacting the demand for foreign currency. This may have implications for exchange rates and international trade.

Broad Money Supply (M2):

The decrease in M2 indicates a contraction in a broader measure of the money supply, which can affect liquidity and economic activity.

Narrow Money Supply (M1):

The significant decrease in narrow money supply (M1) may indicate reduced cash and liquid assets in circulation. A contraction in M1 can have immediate effects on consumer spending and short-term economic activity.

Currency in Circulation:

The increase in currency in circulation might indicate that people are holding more cash, potentially due to concerns about the stability of financial assets or a preference for cash transactions.

Transferable Deposits:

The decrease in transferable deposits can show a decrease in the availability of short-term, liquid assets, which can have implications for financial stability.