The cost of living has become one of the most pressing economic realities shaping everyday life in Tanzania. While the country continues to post relatively strong macroeconomic indicators—such as GDP growth of 5.6% in 2025—these headline figures mask a growing disconnect between household incomes and the actual cost of meeting basic needs. For millions of Tanzanians, especially salaried workers, small entrepreneurs, and urban households, affordability is no longer just a concern—it is a structural challenge.

According to the 2025 Cost of Living Analysis, Tanzania remains 61.2% cheaper overall than the United States, with rent costs approximately 78.3% lower. However, this international comparison obscures a more critical domestic reality: local wages have not kept pace with the rising cost of housing, food, utilities, and essential services.

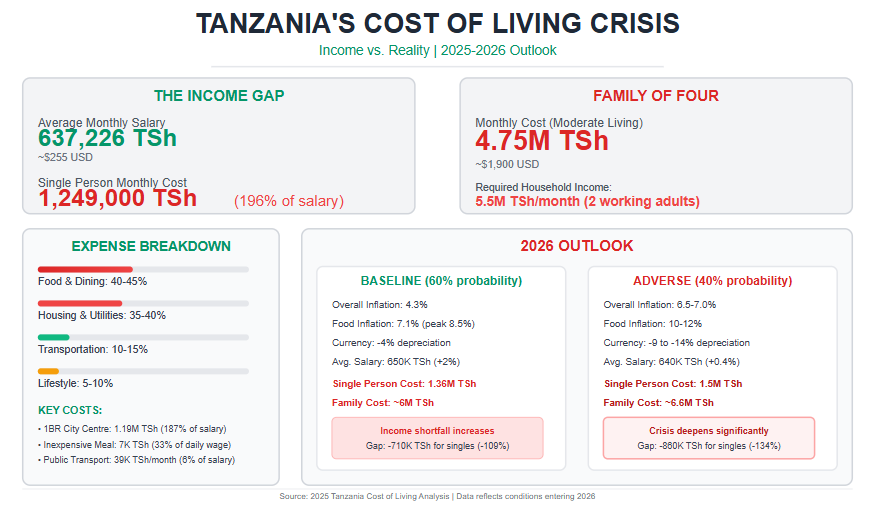

In 2025, the average monthly salary is estimated at 637,226 Tanzanian Shillings (TSh). Against this income, the estimated monthly cost of living for a single person—excluding rent—stands at 1,152,096 TSh, while a family of four requires approximately 4.1 million TSh per month to meet basic needs.

This means that even before accounting for rent, the average worker earns less than half of what is required to sustain a modest standard of living.

Food and dining account for the largest share of household expenditure, consuming 40–45% of monthly income. A simple inexpensive meal costs around 7,000 TSh, equivalent to 33% of an average daily wage, while a mid-range meal for two can exceed 50,000 TSh, or more than two full days of income for many workers.

Even staple grocery items—though relatively affordable individually—accumulate into a significant monthly burden, especially for families.

Housing costs present an even deeper structural challenge. Renting a one-bedroom apartment in a city centre costs approximately 1.19 million TSh per month, representing 187% of the average monthly salary. Even outside city centres, rent for a modest one-bedroom unit consumes over 70% of average income, while three-bedroom family housing exceeds total earnings entirely.

Utilities and internet add a further 300,000 TSh per month, reinforcing the affordability gap.

Transportation remains relatively affordable—public transport costs around 39,000 TSh per month, or about 6% of salary—but private vehicle ownership is increasingly out of reach, with the cost of a new compact car equivalent to nearly 70 months of income.

When all expenses are combined, a budget-conscious single person requires approximately 1.25 million TSh per month, nearly double the average salary. For a family of four, sustainable living requires a household income of 4.8–5.5 million TSh per month, typically achievable only with two high-earning adults or external income sources.

This growing income–cost gap explains rising household debt, reduced savings, informal coping strategies, and increasing vulnerability among urban populations. It also places pressure on businesses, as workers demand higher wages while firms face higher operating costs.

The outlook for 2026 presents both risk and uncertainty. Under the baseline scenario—where political and economic conditions stabilize—overall inflation is projected to rise to 4.3%, with food inflation averaging 7.1% and peaking as high as 8.5% mid-year. The Tanzanian Shilling is expected to depreciate by about 4%, pushing up the cost of imported goods, fuel, and agricultural inputs.

In this scenario, average monthly salaries are projected to rise marginally to around 650,000 TSh, while the monthly cost of living for a single person climbs to 1.36 million TSh—deepening the affordability gap rather than closing it. Families would require close to 6 million TSh per month to maintain a moderate standard of living.

Under an adverse scenario, characterized by prolonged political or economic disruptions, inflation could rise to 6.5–7.0%, food prices could increase by 10–12%, and the currency could depreciate by up to 14%. This would push the monthly cost of living for a single person to 1.5 million TSh, while families could face costs exceeding 5.7 million TSh, further increasing poverty and inequality.

The data sends a clear message: Tanzania’s cost-of-living challenge is no longer about prices alone—it is about income adequacy, economic structure, and policy choices. Without deliberate action on wages, housing supply, food systems, and productivity, economic growth risks becoming disconnected from lived reality. As the country looks toward 2026 and beyond, addressing the cost of living is not just an economic necessity—it is a social and political imperative.

Tanzania offers a significantly lower cost of living compared to the United States, making it an affordable destination for both residents and expatriates. The data shows Tanzania is 61.2% cheaper overall than the US, with rent being 78.3% lower. More on This Topic: Will Tanzania's Robust Central Bank Position Ensure Continued Growth Through 2026?

| Household Type | Monthly Cost (Excluding Rent) | USD Equivalent* |

| Family of Four | 4,110,219 TSh | ~$1,644 |

| Single Person | 1,152,096 TSh | ~$461 |

*Based on approximate exchange rate of 2,500 TSh = 1 USD

| Item | Average Cost | Price Range | % of Daily Wage** |

| Inexpensive Meal | 7,000 TSh | 3,000-15,000 | 33% |

| Mid-Range Meal (2 people) | 50,000 TSh | 30,000-120,000 | 235% |

| Fast Food Combo | 20,000 TSh | 15,000-25,000 | 94% |

| Cappuccino | 5,149 TSh | 2,000-7,500 | 24% |

| Local Beer (0.5L) | 2,500 TSh | 2,000-5,000 | 12% |

**Based on average daily wage of ~21,241 TSh (637,226/30 days)

| Category | Item | Cost | Budget Impact |

| Staples | White Rice (1kg) | 2,711 TSh | Low |

| Fresh Bread (500g) | 1,986 TSh | Low | |

| Eggs (12) | 5,291 TSh | Low | |

| Protein | Chicken (1kg) | 12,346 TSh | Medium |

| Beef (1kg) | 10,500 TSh | Medium | |

| Local Cheese (1kg) | 22,125 TSh | High | |

| Produce | Bananas (1kg) | 2,527 TSh | Low |

| Tomatoes (1kg) | 2,406 TSh | Low | |

| Apples (1kg) | 6,167 TSh | Medium |

Weekly grocery budget for single person: ~60,000-80,000 TSh (26-35% of monthly food costs)

| Type | Location | Monthly Rent | Annual Cost | % of Avg Salary |

| 1-Bedroom | City Centre | 1,194,740 TSh | 14,336,880 | 187% |

| 1-Bedroom | Outside Centre | 452,967 TSh | 5,435,604 | 71% |

| 3-Bedroom | City Centre | 2,060,000 TSh | 24,720,000 | 323% |

| 3-Bedroom | Outside Centre | 822,208 TSh | 9,866,496 | 129% |

Key Insight: Living outside the city centre saves approximately 62% on rent for 1-bedroom apartments and 60% for 3-bedroom apartments.

| Service | Average Cost | Range | % of Rent (1BR Outside) |

| Electricity, Water, Gas, Garbage | 181,593 TSh | 120,000-300,000 | 40% |

| Internet (60+ Mbps) | 99,923 TSh | 50,000-150,000 | 22% |

| Mobile Phone (10GB+) | 28,294 TSh | 10,000-50,000 | 6% |

| Total Utilities | 309,810 TSh | - | 68% |

| Transport Type | Cost | Monthly Impact |

| Public Transport | One-way ticket: 650 TSh | |

| Monthly pass: 39,000 TSh | 6% of salary | |

| Private Transport | Gasoline (1L): 2,979 TSh | |

| New Compact Car: 44,297,674 TSh | 69.5 months salary | |

| Taxi Services | Start fare: 4,000 TSh | |

| Per km: 4,000 TSh |

Budget Recommendation: Public transport is highly affordable at 39,000 TSh/month. For car owners, factor in ~50,000-80,000 TSh monthly for fuel (based on average commuting).

| Category | Item | Cost | Affordability |

| Fitness | Gym Membership | 145,556 TSh | 23% of salary |

| Entertainment | Cinema Ticket | 12,000 TSh | 2% of salary |

| Tennis Court (1hr) | 16,250 TSh | 3% of salary | |

| Clothing | Jeans (Levi's) | 39,375 TSh | 6% of salary |

| Running Shoes | 83,571 TSh | 13% of salary |

| Service | Annual Cost | Monthly Equivalent | % of Annual Salary |

| Preschool/Kindergarten | 18,617,766 TSh | 1,551,480 TSh | 243% |

| International Primary School | 31,434,444 TSh | 2,619,537 TSh | 411% |

Critical Note: International schooling is extremely expensive relative to local salaries, typically requiring expatriate-level income or significant family savings.

| Expense Category | Monthly Cost | % of Total |

| Rent (1BR outside centre) | 450,000 TSh | 36% |

| Utilities | 310,000 TSh | 25% |

| Food (groceries + occasional dining) | 280,000 TSh | 22% |

| Transportation (public) | 39,000 TSh | 3% |

| Mobile/Internet | 50,000 TSh | 4% |

| Entertainment/Misc | 120,000 TSh | 10% |

| TOTAL | 1,249,000 TSh | 100% |

Budget vs Average Salary: 196% (requires income above average)

| Expense Category | Monthly Cost | % of Total |

| Rent (3BR outside centre) | 850,000 TSh | 18% |

| Utilities | 350,000 TSh | 7% |

| Food (groceries + dining) | 1,200,000 TSh | 25% |

| Transportation (car + fuel) | 200,000 TSh | 4% |

| Education (2 children, local school) | 500,000 TSh | 11% |

| Healthcare/Insurance | 300,000 TSh | 6% |

| Entertainment/Misc | 350,000 TSh | 7% |

| Savings | 1,000,000 TSh | 21% |

| TOTAL | 4,750,000 TSh | 100% |

Household Income Needed: ~4,800,000-5,500,000 TSh/month (2 working adults)

Assumption: Unrest subsides by Q1 2026, limited international sanctions

| Economic Indicator | 2025 Actual | 2026 Baseline Projection | Change |

| GDP Growth | 5.6% | 5.8% | +0.2% |

| Overall Inflation | 3.4% | 4.3% | +0.9% |

| Food Inflation | 6.6% | 7.1% (avg), 8.5% (peak July) | +0.5-1.9% |

| Currency (TSh/USD) | 2,692 | 2,799 | -4.0% depreciation |

| Tourism Revenue Growth | +15% | -12% (Q1) then recovery | Net: -5% |

| Foreign Aid | $3B+ annually | Reduced by $150M | -5% |

Assumption: Unrest continues into mid-2026, broader sanctions imposed

| Economic Indicator | 2026 Adverse Projection | Change from Baseline |

| GDP Growth | 4.0% | -1.8% |

| Overall Inflation | 6.5-7.0% | +2.2-2.7% |

| Food Inflation | 10-12% | +2.9-4.9% |

| Currency (TSh/USD) | 2,950-3,100 | -9-14% depreciation |

| FDI Inflows | 50% reduction | -$1.5B |

| Poverty Rate | 26% (from 25%) | +1% |

| Category | 2025 | 2026 Baseline | 2026 Adverse |

| Average Monthly Salary | 637,226 TSh | 650,000 TSh (+2%) | 640,000 TSh (+0.4%) |

| Single Person Monthly Costs | 1,249,000 TSh | 1,360,000 TSh | 1,500,000 TSh |

| Income Shortfall (Single) | -611,774 TSh (-96%) | -710,000 TSh (-109%) | -860,000 TSh (-134%) |

| Family of Four Costs | 4,750,000 TSh | 5,175,000 TSh | 5,700,000 TSh |

| Required Household Income | ~5,500,000 TSh | ~6,000,000 TSh | ~6,600,000 TSh |

Critical Finding: The average salary falls significantly below estimated costs, with shortfalls ranging from 546,679 TSh for single persons to over 3.6 million TSh for families with one earner.