Impact of Monetary Contraction on Tanzania's Economy: Analyzes the decline in net domestic assets, domestic claims, and various money supply measures and its potential effects on economic activity.

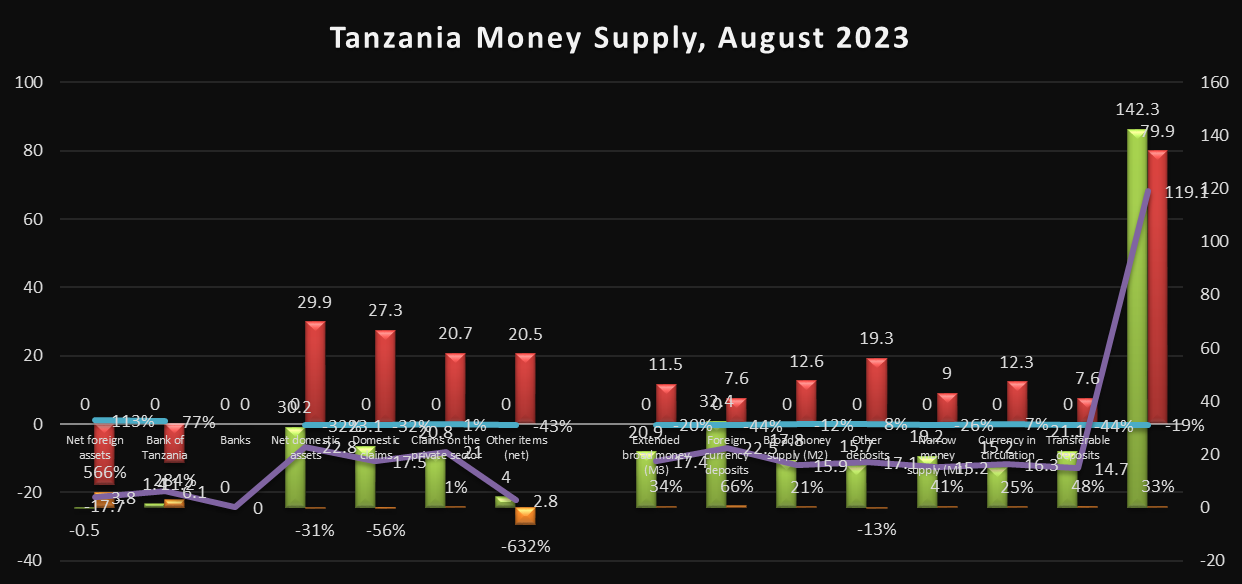

In August 2023, the money supply in Tanzania exhibited various changes and trends. This research is categorized into different components, including net foreign assets, net domestic assets, and different measures of broad and narrow money supply:

Net Foreign Assets:

Bank of Tanzania:

Net Domestic Assets:

Domestic Claims:

Claims on the Private Sector:

Extended Broad Money (M3):

Foreign Currency Deposits:

Broad Money Supply (M2):

Other Deposits:

Narrow Money Supply (M1):

Currency in Circulation:

Transferable Deposits:

The contraction in various money supply measures may raise concerns about economic activity in the short term. However, the increase in net foreign assets and central bank assets shows efforts to stabilize or stimulate the economy, which can be important for long-term economic growth:

Net Foreign Assets:

The significant increase in net foreign assets, both in the one-month and one-year comparisons, indicates a substantial influx of foreign currency into the country. This could be due to factors such as foreign investments, trade balances, or financial inflows. An increase in net foreign assets is generally seen as a positive sign for economic stability.

Bank of Tanzania Assets:

The substantial growth in the assets of the central bank (Bank of Tanzania) is indicative of its monetary policy interventions. It shows that the central bank may be actively managing monetary policy to stabilize or stimulate the economy, which can be a response to economic conditions and goals.

Net Domestic Assets and Domestic Claims:

The decline in net domestic assets and domestic claims indicates a reduction in the money supply generated within the country. A decrease in these figures can be interpreted as a contraction in domestic lending and money creation. This might be an attempt to control inflation or address other monetary concerns.

Claims on the Private Sector:

The slight increase in claims on the private sector can show that banks are willing to extend credit to businesses, potentially supporting economic activity and growth.

Extended Broad Money (M3):

The decrease in the extended broad money supply (M3) shows that the overall money supply in the economy has contracted in the short term. This can have implications for economic growth as a decrease in the money supply may lead to reduced spending and investment.

Foreign Currency Deposits:

The sharp decline in foreign currency deposits may indicate reduced confidence in holding foreign currency or other factors impacting the demand for foreign currency. This may have implications for exchange rates and international trade.

Broad Money Supply (M2):

The decrease in M2 indicates a contraction in a broader measure of the money supply, which can affect liquidity and economic activity.

Narrow Money Supply (M1):

The significant decrease in narrow money supply (M1) may indicate reduced cash and liquid assets in circulation. A contraction in M1 can have immediate effects on consumer spending and short-term economic activity.

Currency in Circulation:

The increase in currency in circulation might indicate that people are holding more cash, potentially due to concerns about the stability of financial assets or a preference for cash transactions.

Transferable Deposits:

The decrease in transferable deposits can show a decrease in the availability of short-term, liquid assets, which can have implications for financial stability.