Implications for Economic Growth in 2023

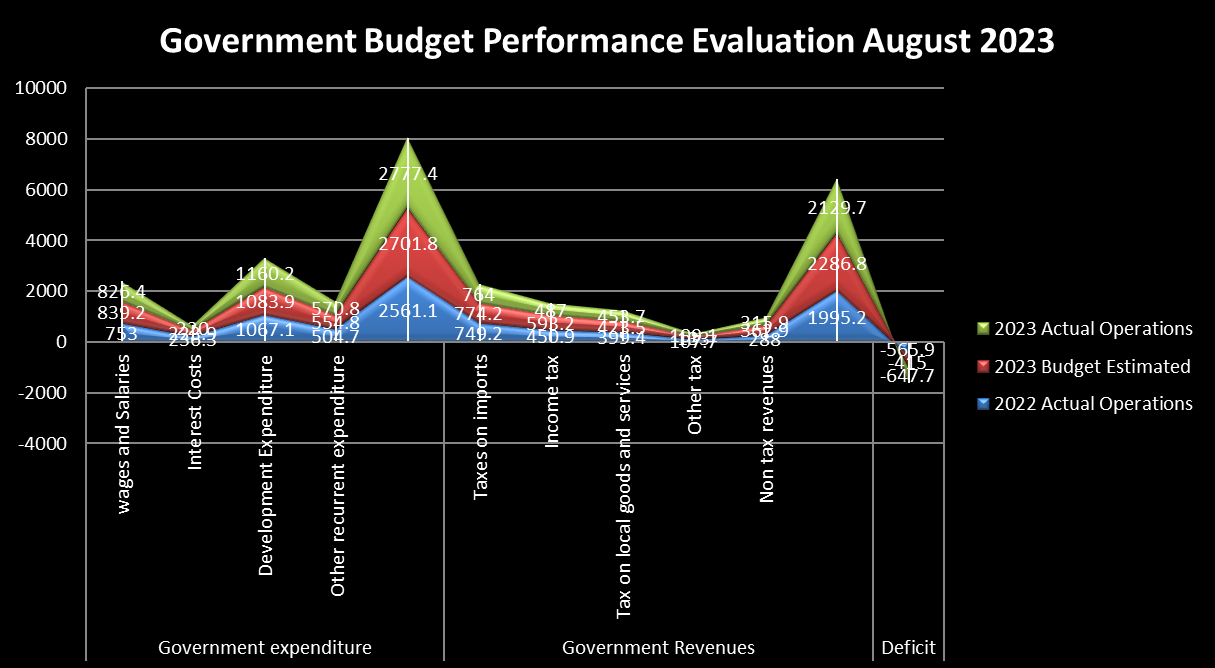

In the Government Budget Performance Evaluation for August 2023, there is a comparison of financial data between 2022 and 2023, with a specific focus on actual operations, the budget, and estimated figures.

The Government Budget Performance Evaluation for August 2023 indicates several notable trends. Government expenditure exceeded the budget primarily due to higher development expenditure, while revenue collection fell short of expectations. The widening deficit is a concerning aspect of this evaluation, as it signifies a substantial increase in the government's financial shortfall, which may necessitate further examination and potential adjustments to financial planning and fiscal policies.

Government Expenditure:

Government Revenues:

Deficit:

The budget deficit is the difference between government expenditure and revenue. In 2023, the government faced a deficit of -647.7 units, which represents a 56% increase from the budgeted deficit of -415 units. This significant increase in the deficit raises concerns about the government's fiscal management.

While there are positive signs such as increased development expenditure, the Government of Tanzania faces challenges in terms of revenue collection and budget deficit management. To promote economic growth, the government may need to address these challenges by improving tax collection, managing deficits effectively, and exploring alternative revenue sources. Additionally, a focus on ensuring that development expenditure is directed toward projects that contribute directly to economic growth could be a key strategy for the future:

Expenditure Prioritization:

The government increased its development expenditure in 2023 by 7% compared to the budget estimate. This indicates a commitment to investing in infrastructure, public projects, and economic development, which can be seen as a positive step toward fostering economic growth. Development expenditure often contributes to job creation and improvements in productivity, which can stimulate economic growth.

Revenue Shortfall:

The government's revenue collection fell short of the budgeted amount in 2023, with a 7% deficit. This shortfall might limit the government's ability to fund projects and services that are crucial for economic growth, such as education, healthcare, and infrastructure development. The revenue underperformance could indicate challenges in tax collection or a need for more efficient revenue generation strategies.

Deficit Increase:

The substantial increase in the budget deficit (56%) is concerning. A widening deficit may result in increased government borrowing, which can have adverse consequences for economic growth if not managed properly. It might lead to higher debt service costs and crowd out other essential public investments, potentially hindering economic growth prospects.

Taxation Challenges:

The data indicates a significant decline in income tax revenue and other tax revenues (18% and 18%, respectively) in 2023. This may suggest challenges in tax collection or economic conditions affecting individuals' income. A reduction in income tax revenue could be indicative of economic struggles for citizens, which can impact economic growth negatively.

Non-Tax Revenues:

The decrease in non-tax revenues (13%) is another area of concern. This suggests that the government's non-tax revenue sources, which could include fees, fines, and other non-tax income, have decreased. This might be due to economic conditions affecting these revenue streams, which can, in turn, impact the government's ability to invest in economic growth initiatives.