Unemployment rate and Economic Growth

Upfront the long term of Public Investment to Macro-economic Growth

Our Health System And Macroeconomic Growth

Represented in a form of policy, Insurance is a contract in which the individual or an entity gets the financial protection in other words reimbursement from the insurance company for the damage (big or small) caused to their property.

The insurer and the insured enter a legal contract for the insurance called the insurance policy that provides financial security from the future uncertainties.

In simple words, insurance is a contract, a legal agreement between two parties i.e.the individual named insured and the insurance company called insurer. In this agreement, the insurer promises to make good the losses of the insured on the happening of the contingency and the insured pays a premium in return for the promise made by the insurer.

The contract of insurance between an insurer and insured is based on certain principles, lets us know the principles of insurance in detail.

The concept of insurance is risk distribution among a group of people, hence cooperation becomes the basic principle of insurance.

To ensure the fairness and for the proper functioning of an insurance contract the insurer and the insured have to uphold the 7 principles of Insurances mentioned below:

Let us understand each principle of insurance with an example.

Principle of Utmost Good Faith

The very basic principle is that both the parties in an insurance contract should act in good faith towards each other i.e. they must provide clear and concise information related to the terms and conditions of the contract.

The Insured should provide all the information related to the subject matter and the insurer must give clear details regarding the contract.

Example – Jacob took a health insurance policy. At the time of taking insurance, he was a smoker and failed to disclose this fact. Later, he got cancer. In such a situation the Insurance company will not be liable to bear the financial burden as Jacob concealed important facts.

Principle of Proximate Cause

This is also called the principle of ‘Causa Proxima’ or the nearest cause. This principle applies when the loss is the result of two or more causes. The insurance company will find the nearest cause of loss to the property. If the proximate cause is the one in which the property is insured, then the company must pay compensation. If it is not a cause the property is insured against, then no payment will be made by the insured.

Example –

Due to fire, a wall of a building was damaged, and the municipal authority ordered it to be demolished. While demolition the adjoining building was damaged. The owner of the adjoining building claimed the loss under the fire policy. The court held that fire is the nearest cause of loss to the adjoining building and the claim is payable as the falling of the wall is an inevitable result of the fire.

In the same example, the wall of the building damaged due to fire, fell down due to storm before it could be repaired and damaged an adjoining building. The owner of the adjoining building claimed the loss under the fire policy.In this case, the fire was a remote cause and storm was the proximate cause hence the claim is not payable under the fire policy.

Principle of Insurable interest

This principle says that the individual (insured) must have an insurable interest in the subject matter. Insurable interest means that the subject matter for which the individual enters the insurance contract must provide some financial gain to the insured and also lead to a financial loss if there is any damage, destruction or loss.

Example – the owner of a vegetable cart has an insurable interest in the cart because he is earning money from it. However, if he sells the cart, he will no longer have an insurable interest in it.

To claim the amount of insurance, the insured must be the owner of the subject matter both at the time of entering the contract and at the time of the accident.

Principle of Indemnity

This principle says that insurance is done only for the coverage of the loss hence insured should not make any profit from the insurance contract. In other words, the insured should be compensated the amount equal to the actual loss and not the amount exceeding the loss. The purpose of the indemnity principle is to set back the insured at the same financial position as he was before the loss occurred. Principle of indemnity is observed strictly for property insurance and not applicable for the life insurance contract.

Example – The owner of a commercial building enters an insurance contract to recover the costs for any loss or damage in future. If the building sustains structural damages from fire, then the insurer will indemnify the owner for the costs to repair the building by way of reimbursing the owner for the exact amount spent on repair or by reconstructing the damaged areas using its own authorized contractors.

Principle of Subrogation

Subrogation means one party stands in for another. As per this principle, After the insured i.e. the individual has been compensated for the incurred loss to him on the subject matter that was insured, the rights of the ownership of that property goes to the insurer i.e. the company.

Subrogation gives the right to the insurance company to claim the amount of loss from the third-party responsible for the same.

Example – If Mr A gets injured in a road accident, due to reckless driving of a third party, the company with which Mr A took the accidental insurance will compensate the loss occurred to Mr A and will also sue the third party to recover the money paid as claim.

Principle of Contribution

Contribution principle applies when the insured takes more than one insurance policy for the same subject matter. It states the same thing as in the principle of indemnity i.e. the insured cannot make a profit by claiming the loss of one subject matter from different policies or companies.

Example – A property worth Rs.5 Lakhs is insured with Company A for Rs. 3 lakhs and with company B for Rs.1 lakhs. The owner in case of damage to the property for 3 lakhs can claim the full amount from Company A but then he cannot claim any amount from Company B. Now, Company A can claim the proportional amount reimbursed value from Company B.

Principle of Loss Minimisation

This principle says that as an owner, it is obligatory on part of the insurer to take necessary steps to minimise the loss to the insured property. The principle does not allow the owner to be irresponsible or negligent just because the subject matter is insured.

Example – If a fire breaks out in your factory, you should take reasonable steps to put out the fire. You cannot just stand back and allow the fire to burn down the factory because you know that the insurance company will compensate for it.

There are two broad categories of insurance:

Life Insurance – The insurance policy whereby the policyholder (insured) can ensure financial freedom for their family members after death. It offers financial compensation in case of death or disability.

While purchasing the Life insurance policy, the insured either pay the lump-sum amount or makes periodic payments known as premiums to the insurer. In exchange, of which the insurer promises to pay an assured sum to the family if insured in the event of death or disability or at maturity.

Depending on the coverage life insurance can be classified into the below-mentioned types:

General Insurance – Everything apart from life can be insured under general insurance. It offers financial compensation on any loss other than death. General insurance covers the loss or damages caused to all the assets and liabilities. The insurance company promises to pay the assured sum to cover the loss related to the vehicle, medical treatments, fire, theft, or even financial problems during travel.

General Insurance can cover almost anything and everything but the five key types of insurances available under it are –

The insurance gives benefits to individuals and organisations in many ways. Some of the benefits are discussed below:

WHAT IS PUBLIC FINANCE?

In simple layman terms, public finance is the study of finance related to government entities. It revolves around the role of government income and expenditure in the economy.

Prof. Dalton in his book Principles of Public Finance states that “Public Finance is concerned with income and expenditure of public authorities and with the adjustment of one to the other”

By this definition, we can understand that public finance deals with income and expenditure of government entity at any level be it central, state or local. However in the modern day context, public finance has a wider scope – it studies the impact of government policies on the economy.

Let’s understand the scope of public finance to understand how public finance impacts the economy.

The main components of public finance include activities related to collecting revenue, making expenditures to support society, and implementing a financing strategy (such as issuing government debt). The main components include:

Tax collection is the main revenue source for governments. Examples of taxes collected by governments include sales tax, income tax (a type of progressive taxes, estate tax, and property tax. Other types of revenue in this category include duties and tariffs on imports and revenue from any type of public services that are not free.

The budget is a plan of what the government intends to have as expenditures in a fiscal year. In the U.S., for example, the president submits to Congress a budget request, the House and Senate create bills for specific aspects of the budget, and then the President signs them into law

Expenditures are everything that a government actually spends money on, such as social programs, education, and infrastructure. Much of the government’s spending is a form of income or wealth redistribution, which is aimed at benefiting society as a whole. The actual expenditures may be greater than or less than the budget.

If the government spends more then it collects in revenue there is a deficit in that year. If the government has less expenditures than it collects in taxes, there is a surplus.

If the government has a deficit (spending is greater than revenue), it will fund the difference by borrowing money and issuing national debt. The U.S. Treasury is responsible for issuing debt, and when there is a deficit, the Office of Debt Management (ODM) will make the decision to sell government securities to investors.

There are three main functions of public finance as follows –

THE ALLOCATION FUNCTION

There are two types of goods in an economy – private goods and public goods. Private goods have a kind of exclusivity to themselves. Only those who pay for these goods can get the benefit of such goods, for example – a car. In contrast, public goods are non-exclusive. Everyone, regardless of paying or not, can benefit from public goods, for example – a road.

The allocation function deals with the allocation of such public goods. The government has to perform various functions such as maintaining law and order, defense against foreign attacks, providing healthcare and education, building infrastructure, etc. The list is endless. The performance of these functions requires large scale expenditure, and it is important to allocate the expenditure efficiently. The allocation function studies how to allocate public expenditure most efficiently to reap maximum benefits with the available public wealth.

THE DISTRIBUTION FUNCTION

There are large disparities of income and wealth in every country in the world. These income inequalities plague society and increase the crime rate of the country. The distribution function of public finance is to lessen these inequalities as much as possible through redistribution of income and wealth.

In public finance, primarily three measures are outlined to achieve this target –

THE STABILIZATION FUNCTION

Every economy goes through periods of booms and depression. It’s the most normal and common business cycles that lead to this scenario. However, these periods cause instability in the economy. The objective of the stabilization function is to eliminate or at least reduce these business fluctuations and its impact on the economy. Policies such as deficit budgeting during the time of depression and surplus budgeting during the time of boom helps achieve the required economic stability.

Now that we understand the study of public finance, we must look into its practical applications. So let us understand the career opportunities in public finance –

INVESTMENT BANKING

An investment banking career in public finance domain entails raising funds for the development of public projects. Investment bankers help government entities in the following three areas –

RESEARCH

This is a fairly large area of public finance careers, and a lot of public finance professionals eventually become researchers. Many large banks, government entities, and world organizations require public finance professionals to consolidate necessary data points for decision making. Thus there is a regular requirement of public finance professionals in the field of research.

ACADEMIA

A lot of public finance professionals eventually go on to become professors and teach public finance in universities and colleges. Not only limited to teaching, but they also participate in university researches to improve understanding of the field and create new tools for efficient practical applications.

Study shows that developing economies are catching up with developed economies in ease of doing business.

Still, the gap remains wide. An entrepreneur in a low-income economy typically spends around 50 percent of the country’s per-capita income to launch a business, compared with just 4.2 percent for an entrepreneur in a high- income economy.

There’s ample room for developing economies to catch up with developed countries on most of the Doing Business indicators. Performance in the area of legal rights, for example, remains weakest among low- and middle-income economies.

The important work countries have done to improve their regulatory environments. Among the 10 economies that advanced the most, efforts were focused on the areas of starting a business, dealing with construction permits, and trading across borders. In general, economies that score the highest share several features on easy doing business including the widespread use of electronic systems and online platforms to comply with regulatory requirements.

At the same time, the least reformed area was resolving insolvency. Putting in place reorganization procedures reduces the failure rates of small and medium-size enterprises and prevents the liquidation of insolvent but viable businesses.

TICGL FIRM is a valuable tool that governments can use to design sound regulatory policies. By giving policymakers a way to benchmark progress, it stimulates policy debate, both by exposing potential challenges and by identifying good practices and lessons learned.

It’s important to note that Doing Business isn’t meant to be an investment guide, but rather a measurement of ease of doing business. Potential investors consider many other factors, such as the overall quality of an economy’s business environment and its national competitiveness, macroeconomic stability, development of the financial system, market size, rule of law, and the quality of the labor force.

In economies with flexible employment regulation, more young women join the labor force.

Low- and lower-middle-income economies tend to regulate employment more than do high- and upper-middle-income economies.

Although labor laws provide essential protections to workers, firms should not have to confront overly burdensome regulation. By changing restrictive labor regulation, economies could better adjust to fast-changing market conditions and dynamic work environments, generating positive outcomes that include smaller informal sectors, increased employment, and higher growth. Reinstating the option of fixed-term contracts would boost youth employment. Similarly, miscalculated changes to the minimum wage could lead to a decline in employment. Easing redundancy procedures facilitates businesses in allocating resources more efficiently, while revising legal restrictions on nonstandard working hours allows both employers and employees to maintain competitiveness.

By the end of this section, you will be able to:

The underpinnings of economic growth are investments in physical capital, human capital, and technology, all set in an economic environment where firms and individuals can react to the incentives provided by well-functioning markets and flexible prices. Government borrowing can reduce the financial capital available for private firms to invest in physical capital. But government spending can also encourage certain elements of long-term growth, such as spending on roads or water systems, on education, or on research and development that creates new technology.

A larger budget deficit will increase demand for financial capital. If private saving and the trade balance remain the same, then less financial capital will be available for private investment in physical capital. When government borrowing soaks up available financial capital and leaves less for private investment in physical capital, the result is known as crowding out.

A larger budget deficit will increase demand for financial capital. If private saving and the trade balance remain the same, then less financial capital will be available for private investment in physical capital. When government borrowing soaks up available financial capital and leaves less for private investment in physical capital, the result is known as crowding out.

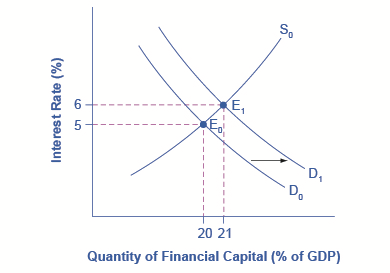

Assume that government borrowing of substantial amounts will have an effect on the quantity of private investment. How will this affect interest rates in financial markets? the original equilibrium (E0) where the demand curve (D0) for financial capital intersects with the supply curve (S0) occurs at an interest rate of 5% and an equilibrium quantity equal to 20% of GDP. However, as the government budget deficit increases, the demand curve for financial capital shifts from D0 to D1. The new equilibrium (E1) occurs at an interest rate of 6% and an equilibrium quantity of 21% of GDP.

Figure 2. Budget Deficits and Interest Rates. In the financial market, an increase in government borrowing can shift the demand curve for financial capital to the right from D0 to D1. As the equilibrium interest rate shifts from E0 to E1, the interest rate rises from 5% to 6% in this example. The higher interest rate is one economic mechanism by which government borrowing can crowd out private investment.

After all, use expansionary monetary policy to reduce interest rates, or in this case, to prevent interest rates from rising? This useful question emphasizes the importance of considering how fiscal and monetary policies work in relation to each other. Imagine a central bank faced with a government that is running large budget deficits, causing a rise in interest rates and crowding out private investment. If the budget deficits are increasing aggregate demand when the economy is already producing near potential GDP, threatening an inflationary increase in price levels, the central bank may react with a contractionary monetary policy. In this situation, the higher interest rates from the government borrowing would be made even higher by contractionary monetary policy, and the government borrowing might crowd out a great deal of private investment.

On the other hand, if the budget deficits are increasing aggregate demand when the economy is producing substantially less than potential GDP, an inflationary increase in the price level is not much of a danger and the central bank might react with expansionary monetary policy. In this situation, higher interest rates from government borrowing would be largely offset by lower interest rates from expansionary monetary policy, and there would be little crowding out of private investment.

However, even a central bank cannot erase the overall message of the national savings and investment identity. If government borrowing rises, then private investment must fall, or private saving must rise, or the trade deficit must fall. By reacting with contractionary or expansionary monetary policy, the central bank can only help to determine which of these outcomes is likely.

Public physical capital investment of this sort can increase the output and productivity of the economy. An economy with reliable roads and electricity will be able to produce more. But it is hard to quantify how much government investment in physical capital will benefit the economy, because government responds to political as well as economic incentives. When a firm makes an investment in physical capital, it is subject to the discipline of the market: If it does not receive a positive return on investment, the firm may lose money or even go out of business.

In some cases, lawmakers make investments in physical capital as a way of spending money in the districts of key politicians. The result may be unnecessary roads or office buildings. Even if a project is useful and necessary, it might be done in a way that is excessively costly, because local contractors who make campaign contributions to politicians appreciate the extra business. On the other hand, governments sometimes do not make the investments they should because a decision to spend on infrastructure does not need to just make economic sense; it must be politically popular as well. Managing public investment so that it is done in a cost-effective way can be difficult.

If a government decides to finance an investment in public physical capital with higher taxes or lower government spending in other areas, it need not worry that it is directly crowding out private investment. Indirectly however, higher household taxes could cut down on the level of private savings available and have a similar effect. If a government decides to finance an investment in public physical capital by borrowing, it may end up increasing the quantity of public physical capital at the cost of crowding out investment in private physical capital, which is more beneficial to the economy would be dependent on the project being considered.

In most countries, the government plays a large role in society’s investment in human capital through the education system. A highly educated and skilled workforce contributes to a higher rate of economic growth. For the low-income nations of the world, additional investment in human capital seems likely to increase productivity and growth. For the United States, tough questions have been raised about how much increases in government spending on education will improve the actual level of education.

Not all spending on educational human capital needs to happen through the government: many college students in the United States pay a substantial share of the cost of their education. If low-income countries of the world are going to experience a widespread increase in their education levels for grade-school children, government spending seems likely to play a substantial role. For the U.S. economy, and for other high-income countries, the primary focus at this time is more on how to get a bigger return from existing spending on education and how to improve the performance of the average high school graduate, rather than dramatic increases in education spending.

Research and development (R&D) efforts are the lifeblood of new technology. According to the National Science Foundation, federal outlays for research, development, and physical plant improvements to various governmental agencies have remained at an average of 8.8% of GDP. About one-fifth should be R&D spending goes to defense and space-oriented research. Although defense-oriented R&D spending may sometimes produce consumer-oriented spinoffs, R&D that is aimed at producing new weapons is less likely to benefit the civilian economy than direct civilian R&D spending.

Fiscal policy can encourage R&D using either direct spending or tax policy. Government could spend more on the R&D that is carried out in government laboratories, as well as expanding federal R&D grants to universities and colleges, nonprofit organizations, and the private sector.

Economic growth comes from a combination of investment in physical capital, human capital, and technology. Government borrowing can crowd out private sector investment in physical capital, but fiscal policy can also increase investment in publicly owned physical capital, human capital (education), and research and development. Possible methods for improving education and society’s investment in human capital include spending more money on teachers and other educational resources, and reorganizing the education system to provide greater incentives for success. Methods for increasing research and development spending to generate new technology include direct government spending on R&D and tax incentives for businesses to conduct additional R&D.