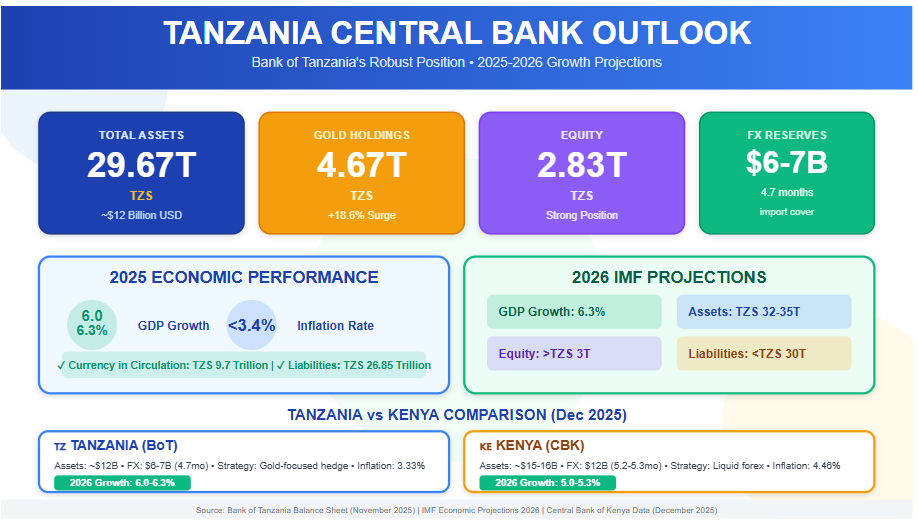

As of November 2025, the Bank of Tanzania (BoT) recorded total assets of TZS 29.67 trillion (approximately USD 12 billion), liabilities of TZS 26.85 trillion, and equity of TZS 2.83 trillion, featuring a remarkable increase in gold holdings (over TZS 4.67 trillion combined) and cash equivalents (TZS 4.45 trillion) driven by record gold sales and tourism revenue—this directly reflects Tanzania's strong economic performance in 2025, with GDP growth of 6.0–6.3%, inflation below 3.4%, and foreign exchange reserves of USD 6–7 billion (4.7 months of import cover). The BoT plays a critical role in managing the economy through monetary policies, such as purchasing domestic gold, controlling currency in circulation (TZS 9.7 trillion), and extending loans to the private sector to stimulate investment and sustainable development.

If this trend continues into 2026, in line with IMF projections (GDP growth of 6.3%), BoT assets are expected to reach TZS 32–35 trillion, liabilities to remain well-managed below TZS 30 trillion, and equity to strengthen above TZS 3 trillion—signaling a steadily growing and resilient economy. In comparison, the Central Bank of Kenya (CBK) holds total assets of approximately KES 2 trillion (USD 15–16 billion) with foreign reserves of around USD 12 billion (5.2–5.3 months of import cover) as of December 2025; while the CBK offers stronger liquid foreign reserves for greater protection against shocks, the BoT's gold-focused strategy provides a hedge against global price volatility, with both institutions contributing to their countries' growth (Kenya projected at 5.0–5.3% in 2026) through effective inflation control and credit stimulation. Read More: Central Bank Asset Dynamics and Tanzania’s Macroeconomic Performance in 2025–2026

In East Africa, the Bank of Tanzania (BoT) and the Central Bank of Kenya (CBK) stand as critical institutions steering their respective economies toward stability and expansion. As of December 2025, both nations exhibit resilient growth trajectories, with Tanzania's GDP expanding by 5.6% in FY2024/25 and projections for 6.0-6.3% in 2025-2026, while Kenya anticipates 5.3% growth in 2025 amid controlled inflation. These figures reflect the central banks' pivotal roles in fostering economic development through monetary policy, reserve management, and financial stability. However, Tanzania's post-election political turmoil in late 2025 introduces risks that could dampen its 2026 outlook, underscoring the interplay between governance and economic progress. This article examines the functions of BoT and CBK in driving growth, offers a comparative lens, and explores how Tanzania's political dynamics might influence its economic path forward.

The BoT, established under the Bank of Tanzania Act of 2006, serves as the guardian of monetary stability while actively supporting broader economic growth. Its primary mandate includes formulating and implementing monetary policy to maintain low inflation—currently at 3.33% in 2025—and ensuring financial system soundness. Beyond price stability, the BoT contributes to development by developing financial markets, promoting inclusive finance, and accumulating foreign reserves to buffer against external shocks. For instance, its November 2025 balance sheet reveals total assets of TZS 29.67 trillion (approximately USD 12 billion), bolstered by an 18.6% surge in gold holdings to TZS 4.67 trillion, reflecting strategic purchases from domestic miners to diversify reserves and support the mining sector—a key driver of Tanzania's export-led growth.

By managing currency in circulation (TZS 9.7 trillion as of November) and extending loans to the private sector (up 62% month-on-month to TZS 1.35 trillion), the BoT stimulates investment in agriculture, tourism, and manufacturing, which employ over 65% of the workforce. In January 2025's Monthly Economic Review, the BoT emphasized aligning monetary policy with growth objectives, such as sustaining reserves at USD 6.17 billion (4.7 months of import cover) to enhance investor confidence and facilitate infrastructure projects like LNG developments. These efforts have helped Tanzania achieve resilient GDP growth despite global headwinds, positioning the bank as a catalyst for long-term development through policies that encourage savings, credit access, and economic diversification.

Similarly, the CBK, mandated by Article 231 of Kenya's Constitution, prioritizes price stability while promoting economic growth and public interest. It formulates monetary policy, issues currency, and regulates the financial sector to foster a stable environment for investment. As of December 2025, the CBK lowered its Central Bank Rate (CBR) to 9.00% from previous levels, aiming to stimulate economic activity, support SMEs, and boost lending amid inflation of 4.46% in November—well within its 2.5-7.5% target. This proactive stance, as outlined in its bi-annual Monetary Policy Statements, regulates money supply growth in line with GDP targets, using tools like Open Market Operations and a Cash Reserve Ratio of 3.25% to manage liquidity.

The CBK's foreign exchange reserves stand at approximately USD 12 billion (5.2-5.3 months of import cover), providing a stronger buffer than Tanzania's and enabling interventions to stabilize the Kenyan Shilling. By encouraging long-term investments and maintaining deflation-free conditions, the bank supports key sectors like agriculture, services, and manufacturing, which have driven Kenya's consistent GDP expansion. For example, its role in currency issuance and management ensures efficient transactions, while financial inclusion initiatives have expanded access to credit, contributing to poverty reduction and job creation. Overall, the CBK acts as an economic enabler, balancing stability with growth to position Kenya as a regional hub.

While both central banks share core functions like inflation control and reserve management, their approaches reflect national economic structures. Tanzania's BoT emphasizes commodity diversification, with gold comprising a significant portion of reserves, aligning with its mining-dependent economy. In contrast, Kenya's CBK relies more on liquid foreign currency holdings, suiting its service-oriented market with higher external trade volumes.

| Aspect | Bank of Tanzania (BoT) | Central Bank of Kenya (CBK) |

| Total Assets (est. Dec 2025) | ~USD 12 billion (TZS 29.67 trillion, Nov data) | ~USD 15-16 billion (KES ~2 trillion est.) |

| FX Reserves | ~USD 6-7 billion (4.7 months import cover) | ~USD 12 billion (5.2-5.3 months cover) |

| Key Growth Focus | Gold purchases, private sector lending; supports mining/tourism | Rate cuts for SMEs; stabilizes services/manufacturing |

| Inflation (2025) | 3.33% | 4.46% (Nov) |

| Policy Tools | Domestic gold acquisition, monetary easing | CBR at 9%, Open Market Operations |

| GDP Contribution | Enables 6%+ growth via reserves buildup | Sustains 5%+ growth through liquidity |

This table highlights Kenya's edge in reserve depth for external resilience, while Tanzania's strategy hedges against volatility through gold. Both institutions have effectively contained inflation below 5%, fostering environments conducive to investment and poverty alleviation.

Tanzania's political stability, once a regional benchmark, has been shaken by the October 2025 general elections, marred by allegations of irregularities and resulting in widespread protests. President Samia Suluhu Hassan secured re-election, but opposition parties like Chadema have decried the process as fraudulent, calling for a UN-overseen transitional government. Post-election violence led to a lethal crackdown by security forces, with UN experts condemning systematic human rights violations, including killings and digital restrictions. By December 2025, the government imposed nationwide protest bans, tightened security, and urged the military to remain apolitical amid escalating tensions.

This unrest could jeopardize Tanzania's 2026 economic projections of 6.1-6.3% GDP growth. Prolonged instability might deter foreign investment, disrupt tourism (a key forex earner), and strain fiscal resources through heightened security spending. If protests escalate, supply chain disruptions could inflate food prices, pushing inflation above the 3-5% target and eroding purchasing power. Moreover, international scrutiny from bodies like the UN and African Union could lead to sanctions or reduced aid, impacting reserves and infrastructure projects. However, if the government addresses grievances through dialogue—as hinted in recent calls for military professionalism—stability could return, allowing the BoT's policies to sustain growth amid global trade tensions.

The BoT and CBK exemplify how central banks can drive economic development by balancing stability with proactive growth measures, from reserve diversification in Tanzania to rate adjustments in Kenya. Their efforts have positioned both nations for robust 2025-2026 performance, with low inflation and adequate buffers against external risks. Yet, Tanzania's political volatility post-2025 elections poses a wildcard, potentially hindering 2026 growth through investor flight and fiscal strain. For sustained progress, addressing governance issues will be as crucial as monetary policy, ensuring these East African powerhouses continue their upward trajectories.