A Comprehensive Analysis of Tanzanian Shilling Performance (2021-2026)

The Tanzanian Shilling (TZS) has experienced significant shifts against the US Dollar (USD) between 2021 and 2026, with exchange rate movements closely tracking global dollar dynamics and United States monetary policy decisions. This comprehensive analysis examines how the Federal Reserve's interest rate policies, global liquidity conditions, and Tanzania's domestic economic fundamentals have interacted to shape currency performance over this critical five-year period.

The TZS remained remarkably stable during this period, with minimal annual changes of less than 1%. This coincided with accommodative global financial conditions following the COVID-19 pandemic, as the US Federal Reserve maintained near-zero interest rates and continued large-scale asset purchases.

| Year | Average Rate (1 USD = TZS) | Lowest Rate | Highest Rate | Annual Change | Key Drivers |

|---|---|---|---|---|---|

| 2021 | ~2,314 | ~2,300 | ~2,324 | -0.5% | Stable period, minimal depreciation |

| 2022 | ~2,326 | ~2,300 | ~2,342 | +0.5-1% | Mild TZS weakening begins |

| 2023 | ~2,422-2,510 | ~2,332 | ~2,519 | +7-8% | Fed aggressive rate hikes, strongest depreciation |

| 2024 | ~2,609-2,615 | ~2,352 | ~2,744 | -3-4% (from 2023 avg) | High volatility, year-end strengthening (~2,445) |

| 2025 | ~2,560-2,584 | ~2,420-2,425 | ~2,701 | +2-3% | Moderate depreciation, mid-year peak then stabilization |

The year 2023 marked the most significant depreciation episode for the Tanzanian Shilling, with the currency weakening by approximately 7-8% against the USD. This sharp movement was not coincidental but directly aligned with the US Federal Reserve's aggressive monetary tightening cycle implemented to combat persistent inflation in the United States.

Key Insight: The 2023 depreciation demonstrates how emerging market currencies like the TZS remain vulnerable to external monetary shocks, even when domestic fundamentals are sound. Tanzania maintained GDP growth averaging 5-6%, inflation within the 3-5% target range, and adequate foreign reserves covering 4-4.5 months of imports, yet could not fully insulate itself from global dollar dynamics.

The TZS/USD exchange rate exhibited unprecedented volatility in 2024, with intra-year swings ranging between TZS 2,352 and TZS 2,744 per USD—a remarkable 392 TZS range. This volatility reflected global market uncertainty surrounding the future trajectory of US monetary policy.

Despite exchange rate pressures, Tanzania has demonstrated strong macroeconomic fundamentals throughout the 2021-2025 period, positioning the country as a resilient lower-middle-income economy transitioning toward upper-middle-income status in line with Vision 2025 and 2050 goals.

| Indicator | Recent Performance | 2026 Projection | Development Impact |

|---|---|---|---|

| Real GDP Growth | ~5.3% (2023) → 5.5-6% (2024-2025) | 6.3% (IMF) | Job creation, infrastructure expansion, poverty reduction |

| Inflation Rate | ~3.3-3.8% (2023-2025) | 3.5% | Stable purchasing power, contained import costs |

| Current Account Deficit | Narrowed to ~2.6-4% of GDP | Improving | Reduced external vulnerability, sustainable financing |

| Foreign Reserves | ~4-4.5 months of imports | Stable | Buffer against shocks, policy flexibility |

| Public Debt | ~45-49% of GDP | Manageable | Fiscal sustainability, development financing capacity |

As of Mid-January 2026: The TZS/USD mid-market rate stands at approximately TZS 2,497-2,500 per USD, representing slight weakening from the 2025 year-end level of around TZS 2,460. This suggests early mild depreciation pressure in 2026, likely driven by ongoing uncertainty about US Federal Reserve policy timing and trajectory.

| Source/Analysis | Predicted Range for 2026 | Year-End Estimate | Key Assumptions |

|---|---|---|---|

| Trading Economics Models | ~2,476 (Q1) → ~2,403 (12 months) | Potential mild strengthening | Global factors favor TZS if Fed cuts materialize |

| CoinCodex / Algorithmic | ~2,464-2,704 (avg ~2,569) | Up to ~2,704 max | Gradual TZS weakening, bullish for USD |

| Gov.Capital / WalletInvestor | ~2,701 mid-year → ~2,571-2,581 | ~2,600-2,700 | Moderate depreciation (~5%) |

| Market Consensus | 2,500-2,700 | ~2,600+ | Fed cuts potentially capping USD strength |

Most analysts converge on a TZS 2,500-2,700 range for 2026, with a likely year-end position around TZS 2,600-2,700 per USD. This implies mild continued depreciation of approximately 3-8% from current levels, though significant Fed rate cuts or strong Tanzanian investment inflows could moderate or reverse this trend.

It is critical to interpret the TZS depreciation not solely as economic weakness but as a complex phenomenon reflecting Tanzania's development trajectory and position in the global financial system.

Policy Implication: The optimal approach involves allowing gradual, market-driven adjustment while using foreign reserves and monetary policy tools to prevent disorderly movements. Tanzania's maintenance of 4-4.5 months of import cover provides adequate policy space for such intervention.

The evolution of the TZS/USD exchange rate over the 2021-2025 period provides compelling evidence that global dollar dynamics and US monetary policy have been the dominant external drivers of exchange rate movements in Tanzania. While domestic fundamentals remained broadly stable—characterized by robust GDP growth averaging 5-6%, low inflation within the 3-5% target range, and adequate foreign exchange reserves—these strengths were insufficient to fully counteract the global tightening of dollar liquidity.

The most pronounced depreciation episode in 2023, when the shilling weakened by 7-8%, coincided directly with the US Federal Reserve's aggressive interest rate hikes. This underscores how shifts in US monetary policy rapidly transmit to emerging and developing economies through capital flows, trade financing costs, and investor portfolio rebalancing. Subsequent volatility in 2024 and moderate depreciation in 2025 further illustrate that expectations surrounding future US rate cuts can significantly influence exchange rate behavior even in the absence of domestic macroeconomic instability.

Importantly, Tanzania's exchange rate depreciation should not be interpreted solely as a sign of economic weakness. Rather, it reflects a combination of structural demand for foreign exchange linked to development-driven imports, the global dominance of the US dollar, and cyclical shifts in international financial conditions. Controlled and gradual depreciation has enhanced export competitiveness in sectors such as gold, tourism, and agriculture, partially offsetting external pressures.

Looking ahead to 2026, with most forecasts placing the TZS/USD rate within the 2,500-2,700 range, the outlook will remain closely tied to the trajectory of US monetary easing, global risk sentiment, and Tanzania's ability to sustain export growth and foreign inflows. Prudent exchange rate management by the Bank of Tanzania, continued inflation control, and export diversification will be essential to mitigating excessive volatility while allowing the exchange rate to adjust in line with underlying economic fundamentals.

Critical Lesson for Developing Economies: Even with sound domestic policies, exchange rate outcomes are increasingly shaped by global monetary forces, reinforcing the need for resilience, policy flexibility, and strategic integration into the global financial system.

Comprehensive Assessment of TZS 128.4 Trillion Debt Position

Tanzania's national debt stock reached approximately TZS 128.4 trillion by the end of November 2025, reflecting a strategic development financing approach heavily anchored on external resources. This comprehensive analysis reveals a debt structure characterized by external dominance at 69.7% of the total, with domestic debt providing a crucial 30.3% stabilizing buffer against foreign exchange volatility.

The debt composition demonstrates the government's continued role as the primary borrower, with the public sector accounting for TZS 103.5 trillion (80.5%) of total obligations, while private sector debt stood at TZS 24.9 trillion (19.5%). This distribution underscores the central government's strategic focus on financing critical infrastructure, social services, and transformative investments essential for Tanzania's development trajectory.

Critically, the monthly debt growth rate of 0.4% signals controlled and sustainable accumulation, a positive indicator for fiscal stability and macroeconomic management. Despite the external-heavy debt structure, sustainability risks remain well-managed through robust foreign exchange reserves covering approximately 4.9 months of imports, an expanding domestic debt market, and prudent fiscal policies maintained by the Bank of Tanzania and Ministry of Finance.

Tanzania's debt position remains manageable and sustainable under current fiscal frameworks, with moderate growth rates, adequate reserve buffers, and development-oriented borrowing strategies supporting long-term economic growth objectives.

| Debt Category | Amount (TZS Trillion) | USD Equivalent | Percentage Share |

|---|---|---|---|

| External Debt | 90.0 | USD 36.1 billion | 69.7% |

| Domestic Debt | 38.4 | USD 15.4 billion | 30.3% |

| Total National Debt | 128.4 | USD 51.5 billion | 100.0% |

Tanzania's debt architecture reveals significant reliance on external financing sources, with nearly 70% of total obligations denominated in foreign currencies. This structure reflects the country's development financing strategy, where concessional loans and development partner financing play pivotal roles in funding large-scale infrastructure projects, including transportation networks, energy facilities, and social infrastructure.

The domestic debt component, while smaller, serves as a critical stabilizing mechanism. It reduces overall foreign exchange exposure, provides diversification in funding sources, and supports the development of local capital markets. The 30.3% domestic share offers important insulation against currency depreciation risks that could otherwise amplify debt servicing costs.

| Indicator | Value | Implication |

|---|---|---|

| Monthly Debt Growth | 0.4% | Controlled, sustainable pace |

| Dominant Component | External (69.7%) | Development-focused financing |

| FX Reserve Cover | 4.9 months | Strong external buffer |

| Exchange Rate | ~2,490 TZS/USD | Stable currency environment |

| Sector | Amount (TZS Trillion) | Percentage Share | Primary Purpose |

|---|---|---|---|

| Public Sector | 103.5 | 80.5% | Infrastructure, social services, strategic investments |

| Private Sector | 24.9 | 19.5% | Business expansion, trade finance, investments |

| Total National Debt | 128.4 | 100.0% | Combined development financing |

The public sector's commanding 80.5% share of national debt reflects Tanzania's development model, where government-led investment drives economic transformation. This concentration is consistent with comparable emerging economies pursuing infrastructure-intensive growth strategies, where public sector borrowing finances critical projects with high social returns but long payback periods.

Private sector debt at 19.5% represents borrowing by businesses, financial institutions, and individuals for commercial purposes. While significantly smaller than public debt, private sector external borrowing supports trade finance, business expansion, and private investment in productive sectors, complementing public sector development efforts.

| Sustainability Indicator | Current Status | Assessment | Risk Level |

|---|---|---|---|

| Debt Composition | External-heavy (69.7%) | FX exposure present | Medium |

| Domestic Debt Buffer | 30.3% of total | Reduces currency risk | Low |

| Monthly Growth Rate | 0.4% | Moderate, controlled | Low |

| FX Reserve Coverage | 4.9 months imports | Strong buffer | Low |

| Debt Purpose | Development-oriented | Growth-enhancing | Low |

Growing Domestic Market: Expanding local debt market provides alternative financing and reduces FX dependency

Adequate Reserves: 4.9 months of import cover significantly exceeds the 3-month adequacy threshold

Productive Investment: Debt financing infrastructure and services with long-term growth potential

Moderate Pace: 0.4% monthly growth indicates disciplined borrowing and debt management

Exchange Rate Volatility: TZS depreciation increases local currency debt service burden on external obligations

Global Interest Rates: Rising international rates affect borrowing costs and refinancing terms

Revenue Performance: Debt sustainability depends on continued strong domestic revenue mobilization

Economic Growth: Maintaining robust GDP growth essential for manageable debt-to-GDP ratios

Tanzania's debt sustainability outlook remains positive under current macroeconomic conditions and fiscal policies. The combination of moderate debt accumulation, productive use of borrowed funds, adequate reserve buffers, and growing domestic financing capacity creates a resilient debt management framework. However, continued vigilance on exchange rate movements, global financial conditions, and revenue performance is essential.

Tanzania's debt management approach balances development financing needs with fiscal sustainability objectives. The government, through the Ministry of Finance and Bank of Tanzania, employs several strategic mechanisms to maintain debt sustainability while funding critical national priorities.

The growth of Tanzania's domestic debt market from 30.3% of total debt represents a strategic achievement with multiple benefits. A deeper local capital market reduces vulnerability to external shocks, provides more flexible financing options, and supports broader financial sector development. The increasing participation of pension funds, insurance companies, and retail investors signals growing confidence in government securities.

Future debt strategy aims to gradually increase the domestic share to 40-45% over the medium term, further reducing foreign exchange exposure while supporting local financial market deepening. This transition requires continued macroeconomic stability, competitive domestic interest rates, and sustained investor confidence.

Understanding Tanzania's debt position requires context of the broader economy. With GDP estimated at approximately TZS 200-210 trillion in 2025, the debt-to-GDP ratio stands around 61-64%, a level considered manageable for a developing economy pursuing infrastructure-intensive growth.

| Economic Metric | Value | Implication for Debt |

|---|---|---|

| Nominal GDP (est.) | ~TZS 205 trillion | Growing denominator improves ratios |

| Debt-to-GDP Ratio | ~62-63% | Within sustainable range |

| GDP Growth Rate | 6.0-6.5% | Outpacing debt growth |

| Revenue-to-GDP | ~15-16% | Supports debt service capacity |

Tanzania's GDP growth consistently exceeding 6% provides crucial debt sustainability support. When economic growth outpaces debt accumulation, debt-to-GDP ratios naturally stabilize or decline over time, even with continued borrowing for development purposes. This dynamic creates fiscal space for strategic investments while maintaining macroeconomic stability.

The 4.9 months of import cover provided by foreign exchange reserves represents a critical strength in Tanzania's debt sustainability framework. This substantial buffer significantly exceeds the 3-month international adequacy standard, providing protection against external shocks and confidence to international creditors.

| Reserve Metric | Value | Assessment |

|---|---|---|

| Import Cover | 4.9 months | Well above 3-month adequacy threshold |

| Reserve Trend | Stable to growing | Strengthening external position |

| External Debt Ratio | 69.7% of total | Reserves provide servicing buffer |

| Currency Stability | Relatively stable TZS | Supports debt servicing capacity |

Strong reserve levels perform multiple functions: they enable smooth debt servicing on external obligations, provide confidence to foreign investors and creditors, support currency stability, and offer protection against unexpected external shocks such as commodity price swings or global financial turbulence.

Looking ahead, Tanzania's debt management success will depend on maintaining the prudent approach evident in current data while adapting to evolving economic circumstances and opportunities. Several strategic priorities emerge from this analysis:

Controlled Growth: 0.4% monthly pace demonstrates disciplined borrowing

Strong Reserves: 4.9 months import cover provides substantial buffer

Productive Use: Infrastructure focus supports long-term growth

Growing Domestic Market: Reducing FX dependency over time

Robust GDP Growth: 6%+ growth outpacing debt accumulation

The combination of prudent debt management, strong economic growth, adequate reserves, and strategic investment focus positions Tanzania well for sustainable development financing. Continued attention to these fundamentals, alongside adaptive responses to global economic conditions, will be essential for maintaining this positive trajectory.

Tanzania's national debt stock of TZS 128.4 trillion as of end-November 2025 reflects a deliberate development financing strategy that balances growth imperatives with fiscal sustainability. The external-dominated structure (69.7%) enables access to large-scale, concessional financing for transformative infrastructure, while the growing domestic component (30.3%) provides critical currency risk mitigation.

Several factors support a positive sustainability assessment. The moderate 0.4% monthly growth rate indicates disciplined borrowing aligned with absorptive capacity. Foreign exchange reserves covering 4.9 months of imports provide a robust external buffer well above international adequacy standards. The productive, development-oriented use of borrowed funds supports future revenue generation and economic growth that outpaces debt accumulation.

The public sector's 80.5% share of total debt reflects government-led development strategy common in infrastructure-intensive growth phases. This concentration, while creating fiscal obligations, finances critical assets with long-term economic and social returns—transportation networks, energy systems, social infrastructure, and economic facilities that enhance productivity and competitiveness.

Risks exist and require ongoing attention. The external-heavy structure creates vulnerability to exchange rate fluctuations, with TZS depreciation increasing local currency debt service costs. Global interest rate trends affect borrowing conditions and refinancing costs. Revenue performance must keep pace with debt service obligations to maintain fiscal balance.

However, these risks are actively managed through strategic debt policies, reserve accumulation, domestic market development, and prudent fiscal management. The expanding domestic debt market, improving revenue mobilization, strong economic growth, and careful project selection all contribute to sustainable debt dynamics.

Looking forward, maintaining this positive trajectory requires continued policy discipline, strategic borrowing focused on high-return investments, ongoing domestic market development, and adaptive responses to global economic conditions. With these elements in place, Tanzania's debt position supports rather than constrains development ambitions, providing financing for transformative investments while preserving macroeconomic stability.

Currency Appreciation Anchors Price Stability and Economic Confidence

Tanzania's price stability in November 2025 was firmly anchored by a strengthening shilling and credible monetary policy framework. The Tanzanian Shilling appreciated significantly from TZS 2,460.54/USD in October to TZS 2,444.81/USD in November, representing a month-on-month gain of TZS 15.73. More impressively, the currency posted an 8.1% year-on-year appreciation, completely reversing the 6.3% depreciation recorded a year earlier.

This currency strength, backed by robust foreign reserves of USD 6.43 billion (equivalent to 4.9 months of import cover), created favorable conditions for price stability. Headline inflation remained firmly contained at 3.4%, comfortably within the Bank of Tanzania's 3-5% target range, while core inflation stood at just 2.3%, signaling subdued demand-side pressures and well-anchored inflation expectations.

The appreciating shilling effectively dampened imported inflation pressures, particularly for fuel and consumer goods. Petrol prices declined to approximately TZS 2,883 per liter, reducing transportation and production costs across the economy. Energy and fuel inflation moderated to 3.8% from 4.0%, while stable foreign exchange availability—evidenced by IFEM turnover of USD 158.7 million—ensured smooth import financing without cost-push shocks.

Headline inflation at 3.4% remains well within the Bank of Tanzania's 3-5% target range, demonstrating effective monetary policy transmission and the stabilizing impact of currency appreciation on import prices. Core inflation at 2.3% confirms that underlying price pressures are subdued, with no signs of demand-driven overheating.

| Indicator | October 2025 | November 2025 | Implication |

|---|---|---|---|

| Average Exchange Rate (TZS/USD) | 2,460.54 | 2,444.81 | Shilling Appreciated |

| Month-on-Month Change | — | –15.73 TZS | Reduced Depreciation Pressure |

| Year-on-Year Change | — | +8.1% Appreciation | Reversal from 6.3% Depreciation (Nov 2024) |

| FX Reserves | — | USD 6,432.9 million | 4.9 Months Import Cover |

| Inflation Measure | November 2024 | October 2025 | November 2025 |

|---|---|---|---|

| Headline Inflation (%) | 3.0 | 3.5 | 3.4 |

| Core Inflation (%) | 3.3 | 2.1 | 2.3 |

| Energy, Fuel & Utilities (%) | 5.7 | 4.0 | 3.8 |

| Food Inflation | Elevated | Moderating | Moderating |

The strengthening Tanzanian Shilling has been instrumental in containing imported inflation through multiple transmission channels.

| Transmission Channel | Evidence from Data | Inflation Impact |

|---|---|---|

| Import Price Channel | Shilling appreciated YoY by 8.1% | ✓ Lower Imported Inflation |

| Fuel Price Effect | Petrol fell to TZS 2,883/litre | ✓ Reduced Transport & Production Costs |

| Exchange Rate Pass-Through | Pass-through subdued and controlled | ✓ Limited Price Shocks |

| FX Availability | IFEM turnover USD 158.7 million | ✓ Stable Import Financing |

Impact: Lower fuel costs reduce transportation expenses, manufacturing costs, and second-round inflation effects across the economy.

Impact: Stronger shilling makes imports cheaper in TZS terms, directly lowering costs for consumer goods, raw materials, and capital equipment.

Impact: Liquid FX market ensures smooth import financing without exchange rate volatility that could trigger price adjustments.

The 8.1% shilling appreciation has effectively reduced the TZS cost of imported goods, particularly fuel and consumer products. This has been a primary factor in keeping headline inflation within target despite global commodity price pressures. The transmission has been smooth and effective, demonstrating the importance of exchange rate stability for price control.

| Monetary Policy Indicator | Value | Relevance to Inflation Control |

|---|---|---|

| Central Bank Rate (CBR) | 5.75% | Anchors inflation expectations; accommodative stance |

| 7-Day IBCM Rate | 6.15% | Within policy corridor; effective transmission |

| Policy Target | Inflation 3-5% | ✓ Achieved (3.4%) |

| FX Intervention (Nov 2025) | USD 52.5 million net sale | Smoothed FX volatility; supported stability |

The relationship between currency stability and inflation control demonstrates a mutually reinforcing dynamic that has anchored Tanzania's macroeconomic performance.

| Performance Indicator | November 2025 Outcome | Inflation Effect |

|---|---|---|

| Exchange Rate | Appreciated 8.1% YoY | ✓ Lower Import-Driven Inflation |

| Fuel Prices | Declining to TZS 2,883/L | ✓ Reduced Second-Round Effects |

| Core Inflation | Fell to 2.3% | ✓ Demand Pressures Subdued |

| Headline Inflation | Stable at 3.4% | ✓ Within Target Range |

| Food Supply | Improved | ✓ Offset Food Price Shocks |

| FX Reserves | USD 6.43 billion (4.9 months) | ✓ Shields Against External Shocks |

Strong exports → FX inflows → Currency appreciation → Lower import costs → Contained inflation → Anchored expectations → Investment confidence → Economic growth

This positive feedback loop demonstrates how Tanzania's export-driven growth model, combined with prudent monetary policy, creates a stable macroeconomic environment conducive to sustained development.

Contribution: Currency strength is the primary anchor for price stability, reducing imported inflation and supporting purchasing power.

Contribution: Declining import costs reduce cost-push pressures throughout the supply chain.

Contribution: Credible and accommodative policy framework maintains confidence while supporting growth.

Contribution: Strong reserves provide resilience against external shocks and maintain confidence.

All four pillars of macroeconomic stability are functioning effectively in Tanzania as of November 2025:

The November 2025 data provides compelling evidence that Tanzania's shilling stability has been instrumental in maintaining low and predictable inflation. The 8.1% year-on-year appreciation of the Tanzanian Shilling, supported by strong export performance and adequate foreign reserves of USD 6.43 billion, has effectively anchored price stability across the economy.

Key achievements demonstrate the effectiveness of this framework:

Headline inflation at 3.4% remains comfortably within the Bank of Tanzania's 3-5% target range, with core inflation at just 2.3% signaling well-controlled demand pressures.

✓ Policy SuccessThe appreciating shilling has reduced imported inflation, particularly for fuel (down to TZS 2,883/L) and consumer goods, dampening cost-push pressures.

✓ Import Cost ReliefEffective monetary policy transmission and strategic FX interventions have maintained stability without aggressive tightening, preserving growth momentum.

✓ Balanced ApproachStrong reserves (4.9 months) and improving external balances provide buffer against shocks, supporting sustained stability.

✓ Shock AbsorptionTanzania's macroeconomic performance in November 2025 demonstrates that exchange rate stability, backed by strong fundamentals and credible monetary policy, is a powerful anchor for inflation control. The appreciating shilling has:

This virtuous cycle—where strong exports generate FX inflows, strengthen the currency, lower import costs, and contain inflation—positions Tanzania favorably for continued macroeconomic stability and sustainable growth into 2026.

To maintain this positive trajectory, Tanzania should continue to:

With inflation anchored at 3.4%, currency appreciating, and reserves adequate, Tanzania's macroeconomic framework provides a solid foundation for sustained development and improved living standards.

Comprehensive Breakdown by Borrower, Currency & Usage

As of November 2025, Tanzania's external debt profile reveals a development-oriented structure predominantly driven by government borrowing. With total external debt standing at USD 36.1 billion, the central government accounts for USD 28.5 billion (78.9%), underscoring the critical role of public financing in infrastructure and social development projects. The debt composition shows significant USD exposure (66.8%), making exchange rate stability essential for sustainable debt management.

The borrower structure reveals overwhelming concentration in the central government, placing primary responsibility for debt management and repayment on public finances.

| Borrower Category | Amount (USD Million) | Percentage Share |

|---|---|---|

| Central Government | 28,528.1 | 78.9% |

| Private Sector | 7,040.8 | 19.5% |

| Public Corporations | 558.9 | 1.5% |

| Total External Debt | 36,127.8 | 100% |

The allocation of external funds demonstrates government-led development financing, with significant resources directed toward infrastructure and social services.

| User of Funds | Amount (USD Million) | Percentage Share |

|---|---|---|

| General Government | 27,922.7 | 77.3% |

| Non-Financial Private Sector | 6,109.4 | 16.9% |

| Financial Institutions | 2,095.7 | 5.8% |

| Total Disbursed Debt | 36,127.8 | 100% |

Currency composition reveals significant USD exposure with partial diversification across major international currencies.

| Currency | Amount (USD Million) | Percentage Share |

|---|---|---|

| US Dollar (USD) | 24,127.7 | 66.8% |

| Euro (EUR) | 6,333.6 | 17.5% |

| Japanese Yen (JPY) | 3,219.0 | 8.9% |

| Chinese Yuan (CNY) | 1,334.5 | 3.7% |

| Other Currencies | 1,112.9 | 3.1% |

| Total | 36,127.8 | 100% |

This external debt profile complements Tanzania's overall debt position, with total national debt standing at approximately USD 51.87 billion, indicating that external debt represents roughly 70% of total obligations. Key contextual factors include:

Tanzania's external debt structure appears manageable and development-oriented, provided that key conditions are maintained:

Tanzania's external debt profile as of November 2025 demonstrates a strategic, development-focused borrowing approach with total obligations of USD 36.1 billion. The structure—predominantly government-borrowed, government-used, and USD-denominated—supports essential infrastructure and social development while creating specific vulnerabilities that require careful management.

The path forward requires balancing development financing needs with prudent debt management, maintaining exchange rate stability through robust export performance, and ensuring borrowed funds generate productive returns. With continued fiscal discipline and strategic economic management overseen by the Bank of Tanzania, the current debt structure remains sustainable and supportive of Tanzania's long-term development objectives.

Tanzania's interest rate environment in November 2025 demonstrated remarkable stability while supporting sustained economic growth. The financial landscape remained balanced with modest upward adjustments reflecting healthy market dynamics rather than stress signals.

Lending rates experienced marginal increases in November 2025, reflecting robust credit demand alongside the 18.1% private-sector lending growth. The adjustments remained modest, ensuring borrowing costs stayed supportive of investment and economic expansion.

| Lending Category | Nov 2024 | Oct 2025 | Nov 2025 | Change |

|---|---|---|---|---|

| Overall Lending Rate | 15.67% | 15.19% | 15.27% | +0.08 pp |

| Short-Term Lending (≤1 year) | 15.56% | 15.50% | 15.53% | +0.03 pp |

| Negotiated Rate (Prime) | 12.77% | 12.40% | 12.61% | +0.21 pp |

The 8 basis point rise in overall lending rates signals healthy credit demand without creating barriers to investment or business expansion.

Negotiated rates at 12.61% remain 2.66 percentage points below the market average, demonstrating preferential pricing for creditworthy borrowers.

Stable lending rates continue supporting the robust 18.1% private-sector credit growth, fueling economic activity across sectors.

Deposit rates showed more pronounced increases in November 2025, particularly for time deposits. This reflects intensified competition among banks for stable, long-term funding sources despite overall ample system liquidity.

| Deposit Category | Nov 2024 | Oct 2025 | Nov 2025 | Change |

|---|---|---|---|---|

| Savings Deposit Rate | 2.69% | 2.93% | 2.88% | -0.05 pp |

| Overall Time Deposit | 8.18% | 8.36% | 8.54% | +0.18 pp |

| 12-Month Deposit Rate | 9.63% | 9.21% | 10.02% | +0.81 pp |

| Negotiated Deposit Rate | 10.14% | 11.22% | 11.67% | +0.45 pp |

The sharp 81 basis point jump in 12-month deposit rates to 10.02% significantly improves returns, encouraging financial savings mobilization.

Rising time and negotiated deposit rates signal banks are competing actively for stable funding despite adequate system liquidity.

Savings rates remained relatively flat, consistent with their high liquidity and transactional nature versus term deposits.

The narrowing of the short-term interest rate spread represents one of November's most significant developments, indicating enhanced banking sector efficiency and improved monetary policy transmission.

| Period | Interest Rate Spread | Change | Interpretation |

|---|---|---|---|

| November 2024 | 5.93% | - | Baseline |

| October 2025 | 6.28% | +0.35 pp | Temporary widening |

| November 2025 | 5.51% | -0.77 pp | Significant improvement |

Interest rate movements in November 2025 occurred within a well-anchored monetary policy framework, demonstrating effective transmission from the Bank of Tanzania's policy stance to market rates.

| Indicator | Value | Policy Significance |

|---|---|---|

| Central Bank Rate (CBR) | 5.75% | Accommodative stance anchoring market rates |

| 7-Day IBCM Rate (Average) | 6.15% | Within policy corridor, effective transmission |

| Inflation Rate | 3.4% | Well within 3-5% target range |

| Private Sector Credit Growth | 18.1% | Strong lending supporting economic expansion |

Market rates adjusted in line with monetary policy without destabilizing inflation, confirming the Bank of Tanzania's control over financial conditions.

The combination of low inflation (3.4%) and strong credit growth (18.1%) demonstrates successful policy calibration supporting growth without overheating.

The 5.75% policy rate remains supportive, with ample room for adjustment if economic conditions change, providing policy flexibility.

| Aspect | Lending Rates | Deposit Rates |

|---|---|---|

| Direction (Nov 2025) | Slight increase (+0.08 pp) | Moderate increase (+0.81 pp on 12-month) |

| Main Driver | Strong credit demand (18.1% growth) | Bank competition for stable deposits |

| Economic Impact | Supports investment and business expansion | Encourages savings mobilization |

| Risk Signal | Contained - rates remain affordable | Low - reflects healthy competition |

| Year-on-Year Trend | Down 0.40 pp from Nov 2024 | Up 0.39 pp on 12-month from Nov 2024 |

Looking ahead to early 2026, the interest rate environment is expected to remain stable with several supporting factors:

The November 2025 interest rate data paints a picture of a mature, well-functioning financial system supporting Tanzania's economic ambitions. The modest rise in lending rates reflected healthy credit demand rather than monetary tightening, while the more pronounced increases in deposit rates rewarded savers and demonstrated vibrant bank competition.

Most significantly, the narrowing interest rate spread from 6.28% to 5.51% signals improved banking sector efficiency and effective monetary policy transmission. This development, combined with low inflation at 3.4%, stable policy rates, and robust 18.1% private-sector credit growth, creates an optimal environment for sustained economic expansion.

As Tanzania advances its development agenda, this balanced interest rate environment—affordable lending supporting investment, attractive deposit rates encouraging savings, and efficient intermediation facilitating resource allocation—provides a solid foundation for continued progress toward middle-income status and beyond.

External Sector Strengthens: 34.3% Year-on-Year Improvement in Current Account Deficit

Tanzania's external sector demonstrated remarkable resilience and improvement in November 2025, with the 12-month cumulative current account deficit narrowing substantially to USD 3.43 billion, representing a significant 34.3% year-on-year improvement from USD 5.22 billion recorded in November 2024. This positive trajectory was primarily driven by robust tourism receipts, enhanced transport services, and a strategic balance between export growth and import moderation.

The current account performance in November 2025 reflects a fundamental strengthening of Tanzania's external position. The substantial narrowing of the deficit from USD 5.22 billion to USD 3.43 billion demonstrates improved export competitiveness, particularly in service sectors, and effective economic policies that have enhanced external sustainability.

| Period | Current Account Balance (USD Million) | Year-on-Year Change |

|---|---|---|

| November 2024 | -5,217.3 | — |

| October 2025 | -3,622.4 | +30.6% |

| November 2025 | -3,425.7 | +34.3% |

Services exports reached USD 6.80 billion for the 12-month period ending November 2025. Tourism dominated with USD 3.79 billion (55.8%), while transportation services contributed USD 2.08 billion (30.6%), reinforcing Tanzania's role as a regional logistics hub.

| Service Category | Amount (USD Million) | Share |

|---|---|---|

| Travel (Tourism) | 3,791.4 | 55.8% |

| Transportation | 2,079.3 | 30.6% |

| Other Business Services | 451.5 | 6.6% |

| Government Services | 257.3 | 3.8% |

| Telecommunications & ICT | 222.6 | 3.2% |

| Total | 6,802.1 | 100% |

Services payments totaled USD 5.47 billion, with transportation accounting for USD 2.46 billion (44.9%), reflecting freight and logistics costs typical for a trade-dependent economy.

| Service Category | Amount (USD Million) | Share |

|---|---|---|

| Transportation | 2,458.9 | 44.9% |

| Other Business Services | 1,333.7 | 24.4% |

| Travel | 777.2 | 14.2% |

| Government Services | 464.5 | 8.5% |

| Telecommunications & ICT | 438.6 | 8.0% |

| Total | 5,472.9 | 100% |

Tanzania achieved a net services surplus of USD 1.33 billion, with receipts significantly exceeding payments. This surplus was crucial in offsetting the merchandise trade deficit.

| Item | Amount (USD Million) |

|---|---|

| Total Services Receipts | 6,802.1 |

| Total Services Payments | 5,472.9 |

| Net Balance | +1,329.2 |

Tanzania's external sector performance in November 2025 represents a significant milestone. The 34.3% improvement in the current account deficit to USD 3.43 billion, driven by tourism-led services exports of USD 6.80 billion and a net surplus of USD 1.33 billion, demonstrates structural economic strengths and effective policy implementation.

Moving forward, sustaining this momentum requires continued investment in tourism infrastructure, competitive exchange rates, and policies supporting export competitiveness. The external sector's resilience provides a solid foundation for Tanzania's broader economic development objectives.

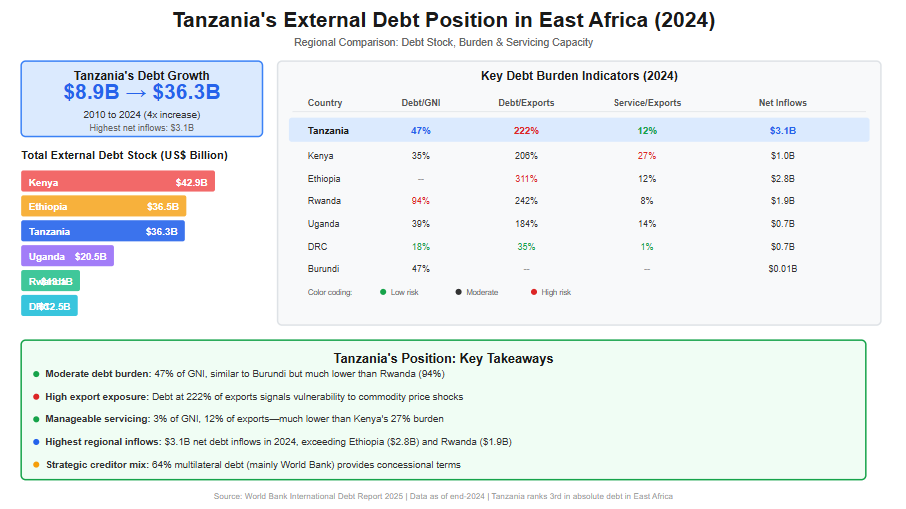

Over the past decade, Tanzania’s external debt has expanded rapidly, reflecting both the country’s ambitious development agenda and growing reliance on external financing to bridge fiscal and infrastructure gaps. According to the International Debt Report 2025, Tanzania’s total external debt stock increased more than fourfold—from US$8.9 billion in 2010 to US$36.3 billion by end-2024. This sharp rise underscores the scale of public investment undertaken during this period, particularly in transport infrastructure, energy, and social sectors, but it also raises important questions regarding debt sustainability and regional competitiveness.

In East Africa, Tanzania currently ranks among the top three most indebted countries in absolute terms, alongside Kenya and Ethiopia. By end-2024, Kenya recorded the highest external debt stock at US$42.9 billion, followed by Ethiopia (US$36.5 billion) and Tanzania (US$36.3 billion). While Tanzania’s debt level is lower than Kenya’s, it is significantly higher than that of Uganda (US$20.5 billion), Rwanda (US$13.1 billion), and the Democratic Republic of Congo (US$12.5 billion). This positioning places Tanzania as a major regional borrower, reflecting the relative size of its economy and its sustained access to concessional and semi-concessional financing.

From a debt burden perspective, Tanzania’s external debt stood at 47% of Gross National Income (GNI) in 2024—moderate by regional standards. This ratio is similar to Burundi (47%) but substantially lower than Rwanda’s 94%, indicating comparatively lower vulnerability than some peers. However, when measured against export earnings, Tanzania’s external debt reached 222% of exports, signaling a high exposure to external shocks, especially fluctuations in commodity prices and global demand. This ratio is higher than Uganda’s (184%) and Kenya’s (206%), though still below Ethiopia’s elevated level of 311%.

Debt servicing pressures in Tanzania remain relatively manageable compared to other East African economies. In 2024, debt service payments accounted for 3% of GNI and 12% of export earnings, significantly lower than Kenya, where debt service absorbed 27% of exports, and comparable to Rwanda’s levels. This reflects Tanzania’s continued reliance on multilateral creditors, which account for approximately 64% of public and publicly guaranteed (PPG) external debt, with the World Bank alone representing nearly half of total PPG debt. Such creditor composition has helped moderate repayment pressures through longer maturities and concessional terms.

Nevertheless, Tanzania recorded the highest net external debt inflows in East Africa in 2024, at US$3.1 billion, exceeding Ethiopia (US$2.8 billion) and Rwanda (US$1.9 billion). This trend highlights ongoing financing needs and signals that debt accumulation is likely to persist in the medium term. As regional peers increasingly face tightening global financial conditions, Tanzania’s future debt trajectory will depend heavily on export performance, fiscal discipline, and the productivity of debt-financed investments.

Overall, Tanzania’s external debt position reflects a delicate balance: stronger than highly indebted peers such as Rwanda and Kenya in terms of servicing capacity, yet more exposed than Uganda and DRC when viewed through export and inflow dynamics. This evolving landscape makes continuous debt monitoring, regional benchmarking, and strategic borrowing essential for safeguarding macroeconomic stability and sustaining long-term growth. Read More of This Topic: Who Is Financing Tanzania’s Public Debt in 2024—and What Does It Mean for Sustainability?

The following table summarizes Tanzania's external debt data across key years, as extracted from the International Debt Report 2025. All figures are in US$ million unless otherwise noted.

| Indicator | 2010 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Total external debt stocks | 8,940 | 25,772 | 28,818 | 30,444 | 34,585 | 36,343 |

| Long-term external debt stocks | 6,904 | 22,055 | 23,589 | 24,533 | 28,271 | 30,898 |

| Public and publicly guaranteed debt from: | ||||||

| Official creditors | 5,546 | 15,355 | 15,502 | 16,308 | 18,296 | 20,005 |

| Multilateral | 4,391 | 11,243 | 11,526 | 12,615 | 14,655 | 16,435 |

| of which: World Bank | 3,248 | 8,148 | 8,290 | 9,228 | 10,989 | 12,097 |

| Bilateral | 1,155 | 4,112 | 3,975 | 3,693 | 3,641 | 3,571 |

| Private creditors | 135 | 2,209 | 3,436 | 3,244 | 4,090 | 4,272 |

| Bondholders | .. | .. | .. | .. | .. | .. |

| Commercial banks and others | 135 | 2,209 | 3,436 | 3,244 | 4,090 | 4,272 |

| Private nonguaranteed debt from: | 1,224 | 4,491 | 4,651 | 4,981 | 5,886 | 6,621 |

| Bondholders | .. | .. | .. | .. | .. | .. |

| Commercial banks and others | 1,224 | 4,491 | 4,651 | 4,981 | 5,886 | 6,621 |

| Use of IMF credit and SDR allocations | 647 | 274 | 1,357 | 1,444 | 1,760 | 2,062 |

| IMF credit | 354 | 0 | 557 | 683 | 993 | 1,316 |

| SDR allocations | 293 | 274 | 800 | 761 | 767 | 746 |

| Short-term external debt stocks | 1,389 | 3,442 | 3,872 | 4,467 | 4,554 | 3,383 |

| Disbursements, long-term | 1,361 | 1,459 | 3,049 | 3,104 | 5,200 | 4,112 |

| Public and publicly guaranteed sector | 1,145 | 1,181 | 2,865 | 2,421 | 4,030 | 3,500 |

| Private sector not guaranteed | 216 | 279 | 184 | 683 | 1,171 | 612 |

| Principal repayments, long-term | 134 | 984 | 1,142 | 1,533 | 1,547 | 1,204 |

| Public and publicly guaranteed sector | 55 | 968 | 1,118 | 1,179 | 1,282 | 1,126 |

| Private sector not guaranteed | 79 | 15 | 25 | 353 | 266 | 78 |

| Interest payments, long-term | 51 | 365 | 319 | 429 | 603 | 725 |

| Public and publicly guaranteed sector | 34 | 363 | 315 | 377 | 547 | 691 |

| Private sector not guaranteed | 17 | 2 | 4 | 52 | 56 | 34 |

The table below focuses on PPG debt in 2024, broken down by creditor type and key creditors where specified. Note that IMF credit is reported separately in the raw data but is included here as part of overall PPG (under multilateral creditors) per the report's figure, which explicitly incorporates it. The total PPG debt (including IMF credit) is approximately $25,593 million (long-term PPG $24,277 + IMF credit $1,316). Specific creditor breakdowns (e.g., China, AfDB) are derived from the report's Figure 1, which provides a visual pie chart; percentages are approximate and may reflect rounded values.

| Creditor Type | Sub-Creditor/Creditor | Amount (US$ million) | % of Total PPG (incl. IMF) |

| Multilateral (excl. IMF) | Total Multilateral (excl. IMF) | 16,435 | ~64% |

| World Bank | 12,097 | ~47% | |

| AfDB (African Development Bank) | ~3,583 (est. based on 14%) | ~14% | |

| Other Multilateral | ~4,351 (est. based on 17%) | ~17% | |

| IMF Credit | IMF | 1,316 | ~5% (reported as 6% in figure) |

| Bilateral | Total Bilateral | 3,571 | ~14% |

| China | ~2,559 (est. based on ~10%; figure label may have OCR variance) | ~10% | |

| India | ~512 (est. based on 2%) | ~2% | |

| Korea, Rep. | ~512 (est. based on 2%) | ~2% | |

| France | ~256 (est. based on 1%) | ~1% | |

| Other Bilateral | ~1,538 (est. based on 6%) | ~6% | |

| Private Creditors | Total Private | 4,272 | ~17% |

| Bondholders | .. | 0% | |

| Commercial Banks and Others | 4,272 | ~17% (incl. other commercial ~4%) | |

| Total PPG (incl. IMF) | 25,593 | **100% |

The International Debt Report 2025 provides detailed external debt statistics for low- and middle-income countries, including East African nations. Below is a comparison focusing on Tanzania and other East African countries (Burundi, Democratic Republic of the Congo (DRC), Ethiopia, Kenya, Rwanda, Somalia, and Uganda). The data is drawn from the report's country tables and snapshots. Note that some values for Ethiopia and Burundi are missing in the report (indicated as ".."), and for Somalia, I supplemented with data from the World Bank's online IDS portal as the PDF extraction for that country was incomplete. Population for Uganda is estimated based on report context (not explicitly listed in the extracted data). All figures are in US$ million unless otherwise noted.

| Country | Total External Debt Stock (US$ million) | External Debt % of GNI | External Debt % of Exports | Debt Service % of GNI | Debt Service % of Exports | Net Debt Inflows (US$ million) | GNI (US$ million) | Population (million) |

| Tanzania | 36,343 | 47 | 222 | 3 | 12 | 3,056 | 76,808 | 69 |

| Burundi | 1,024 | 47 | .. | 2 | .. | 10 | 2,173 | 14 |

| DRC | 12,485 | 18 | 35 | 1 | 1 | 651 | 68,396 | 109 |

| Ethiopia | 36,548 | .. | 311 | .. | 12 | 2,817 | .. | 132 |

| Kenya | 42,886 | 35 | 206 | 5 | 27 | 1,006 | 122,557 | 56 |

| Rwanda | 13,050 | 94 | 242 | 3 | 8 | 1,900 | 13,901 | 14 |

| Somalia | 2,837 | .. | .. | .. | .. | .. | .. | 18 |

| Uganda | 20,534 | 39 | 184 | 2 | 14 | 676 | 52,361 | 50 |

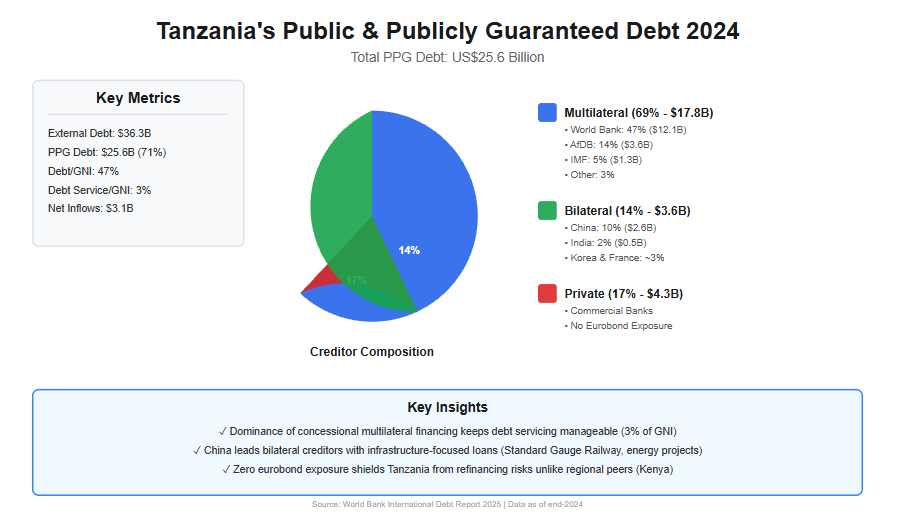

By the end of 2024, Tanzania’s external debt landscape had reached a critical juncture, reflecting a decade of accelerated borrowing to finance infrastructure, energy, and social development priorities. According to the World Bank’s International Debt Report 2025, Tanzania’s total external debt stock stood at US$36.3 billion, more than four times higher than the US$8.9 billion recorded in 2010. Within this total, Public and Publicly Guaranteed (PPG) debt accounted for approximately US$25.6 billion, underscoring the central role of government-backed borrowing in shaping the country’s fiscal position.

The structure of Tanzania’s public debt financing in 2024 is heavily tilted toward multilateral institutions, a feature that distinguishes Tanzania from several of its East African peers and has important implications for sustainability. Multilateral creditors—including the World Bank, the African Development Bank (AfDB), and the International Monetary Fund (IMF)—collectively financed about 69% of Tanzania’s PPG external debt, equivalent to roughly US$17.8 billion. The World Bank alone accounted for US$12.1 billion, representing nearly half (47%) of total PPG debt, making it Tanzania’s single largest creditor. This reliance on concessional multilateral finance has helped Tanzania maintain relatively low debt-servicing pressures, with debt service consuming only 3% of Gross National Income (GNI) and 12% of export earnings in 2024—well below Kenya’s 5% of GNI and 27% of exports.

Bilateral creditors played a secondary but strategically significant role, financing approximately 14% of PPG debt, or US$3.6 billion. Within this category, China emerged as the dominant bilateral lender, holding an estimated US$2.6 billion, equivalent to around 10% of total PPG debt. These loans are largely associated with large-scale infrastructure projects, including transport and energy investments, which have long-term growth potential but also carry execution and revenue risks. Other bilateral partners—such as India, Korea, and France—collectively accounted for smaller shares (each around 1–2%), often targeting sector-specific development initiatives.

Private creditors represented a growing but more risk-sensitive component of Tanzania’s public debt portfolio. In 2024, private creditors—primarily commercial banks and other private lenders—held approximately US$4.3 billion, or 17% of PPG debt. Notably, Tanzania had no exposure to international bondholders, unlike regional peers such as Kenya. This absence of eurobond debt has shielded Tanzania from rollover and refinancing risks during a period of elevated global interest rates, reinforcing short-term debt sustainability. However, private loans typically carry higher interest rates and shorter maturities, meaning their rising share could increase fiscal pressure if not carefully managed.

From a sustainability perspective, Tanzania’s creditor composition offers both reassurance and caution. On the one hand, the dominance of concessional multilateral financing has kept debt servicing costs manageable and supported macroeconomic stability, even as net external debt inflows reached US$3.1 billion in 2024—the highest in East Africa. On the other hand, continued reliance on external borrowing, particularly in a context where external debt equals 47% of GNI and 222% of export earnings, exposes Tanzania to exchange rate shocks and export volatility.

Ultimately, who finances Tanzania’s public debt matters as much as how much is borrowed. In 2024, Tanzania’s public debt sustainability was underpinned by favorable creditor terms rather than low debt levels. Maintaining this position will require disciplined borrowing, stronger export growth, and ensuring that debt-financed investments generate sufficient economic returns to support repayment over the medium to long term. Read More of This Topic: External Debt Stock by Borrower

PPG debt includes loans to the public sector that are guaranteed by the government, encompassing borrowings from official creditors (multilateral and bilateral) and private sources. By the end of 2024, Tanzania's PPG debt (including IMF credit) stood at approximately US$25.6 billion, accounting for a significant portion of the country's long-term external debt. This figure reflects Tanzania's strategy of leveraging concessional financing to fund development priorities, but it also underscores vulnerabilities to global interest rate shifts and currency fluctuations.

The creditor composition reveals a heavy dependence on multilateral lenders, which provide favorable terms such as longer maturities and lower interest rates. This has helped keep debt servicing burdens manageable—at 3% of GNI and 12% of exports in 2024—compared to regional peers like Kenya (5% of GNI and 27% of exports). However, with net debt inflows reaching US$3.1 billion in 2024, the highest in East Africa, ongoing borrowing could strain future fiscal space if export growth falters.

The following table presents Tanzania's PPG debt in 2024, categorized by creditor type and key sub-creditors. Data is sourced from the International Debt Report 2025, with specific breakdowns estimated from the report's visual representations (e.g., pie charts in Figure 1). Amounts are in US$ million, and percentages are approximate, reflecting rounded values from the report. IMF credit is integrated under multilateral creditors, as per the report's methodology, contributing to the total PPG figure of US$25,593 million (derived from long-term PPG of US$24,277 million plus IMF credit of US$1,316 million).

| Creditor Type | Sub-Creditor/Creditor | Amount (US$ million) | % of Total PPG (incl. IMF) |

| Multilateral (excl. IMF) | Total Multilateral (excl. IMF) | 16,435 | ~64% |

| World Bank | 12,097 | ~47% | |

| AfDB (African Development Bank) | ~3,583 (est.) | ~14% | |

| Other Multilateral | ~4,351 (est.) | ~17% | |

| IMF Credit | IMF | 1,316 | ~5% (reported as 6% in figure) |

| Bilateral | Total Bilateral | 3,571 | ~14% |

| China | ~2,559 (est.) | ~10% | |

| India | ~512 (est.) | ~2% | |

| Korea, Rep. | ~512 (est.) | ~2% | |

| France | ~256 (est.) | ~1% | |

| Other Bilateral | ~1,538 (est.) | ~6% | |

| Private Creditors | Total Private | 4,272 | ~17% |

| Bondholders | .. | 0% | |

| Commercial Banks and Others | 4,272 | ~17% (incl. other commercial ~4%) | |

| Total PPG (incl. IMF) | 25,593 | 100% |

The dominance of multilateral creditors (around 69% including IMF) in Tanzania's PPG debt portfolio is a double-edged sword. On one hand, it ensures concessional terms that support debt sustainability; the World Bank and AfDB together account for over 60% of this category, financing projects aligned with Tanzania's National Development Vision 2025. IMF credit, at US$1,316 million, has provided balance-of-payments support, particularly post-COVID recovery.

Bilateral creditors, making up 14%, highlight strategic partnerships. China's ~10% share is notable, linked to major investments like the Standard Gauge Railway and power plants. Smaller contributions from India, Korea, and France often focus on sector-specific aid, such as agriculture and technology.

Private creditors' 17% share signals maturing financial markets but introduces risks, as these loans typically carry higher interest rates and shorter terms. With no bondholder debt reported, Tanzania has avoided eurobond exposures seen in peers like Kenya, reducing immediate refinancing pressures.

In the East African context, Tanzania's PPG composition favors stability compared to Rwanda (94% debt-to-GNI) or Ethiopia (311% debt-to-exports). However, as global conditions tighten, diversifying creditors and boosting exports (e.g., through mining and agriculture) will be crucial. The report emphasizes debt transparency and management reforms to mitigate risks.

In September 2025, Tanzania’s macroeconomic environment remained exceptionally stable, marked by a stronger shilling and low, well-anchored inflation. The exchange rate averaged TZS 2,471.69 per USD, appreciating by 0.75% month-on-month and 9.4% year-on-year—an impressive reversal from the sharp depreciation recorded in 2024. This stability was supported by strong export inflows from gold, cereals, and cashew nuts, alongside robust tourism earnings and targeted Bank of Tanzania interventions. Inflation held steady at 3.4%, well within the 3–5% target range and aligned with regional convergence criteria. Food inflation remained elevated at 7%, but non-food (1.9%) and energy inflation (3.7%) stayed subdued, helped by lower global oil prices and a strong currency. Together, these elements created a stable price environment, improving import affordability, reducing cost pressures for households and businesses, and enhancing the effectiveness of monetary policy transmission.

The Tanzania shilling remained relatively strong and stable in 2025.

Key Figures

Drivers of Shilling Strength

Inflation remained low, stable, and within official target range.

Inflation Figures

Components

When the shilling is stable/strong:

| Indicator | Value | Movement | Economic Meaning |

| Exchange rate (TZS/USD) | 2,471.69 | Appreciated | Supports price stability |

| Monthly exchange rate change | +0.75% | Strengthened | Lower import costs |

| Annual exchange rate change | +9.4% | Appreciated | Reduces imported inflation |

| Headline inflation | 3.4% | Stable | Within target |

| Food inflation | 7.0% | Slightly eased | Adequate domestic food supplies |

| Core inflation | 2.2% | Slightly up | Driven by household goods & transport |

| Energy/fuel inflation | 3.7% | Down | Supported by stable shilling and oil prices |

| Interbank rate | 6.45% | Within policy corridor | Monetary policy effective |

The interplay between the Tanzanian shilling's strength and low inflation in September 2025, as detailed in Sections 2.5 (Financial Markets, specifically the Interbank Foreign Exchange Market) and 2.2 (Inflation Developments) of the Bank of Tanzania's (BOT) Monthly Economic Review (October 2025), underscores a virtuous cycle of external resilience and price stability. The shilling appreciated 0.75% monthly (average TZS 2,471.69/USD vs. TZS 2,490.16 in August) and 9.4% annually—reversing the 10.1% depreciation seen in September 2024—amid robust export inflows (gold, cash crops, cashews), tourism earnings, and BOT's targeted intervention (net USD 11 million sale; Chart 2.5.3). This stability dovetails with headline inflation holding at 3.4% (within 3–5% target and EAC/SADC criteria), driven down by easing food (7.0%) and energy (3.7%) pressures. Below, I outline the implications, integrating broader economic dynamics like 6.3% Q2 GDP growth and accommodative policy (CBR 5.75%).

1. Shilling Appreciation: Bolstering External Buffers and Import Affordability

2. Inflation Stability: Reinforced by Currency Strength and Supply Factors

3. Interlinkages: Shilling Strength Amplifying Monetary Effectiveness and Growth

4. Macroeconomic and Policy Context from the Review

| Indicator | Value (Sep 2025) | Movement (vs. Aug 2025) | Economic Implication |

| Exchange Rate (TZS/USD Avg) | 2,471.69 | Appreciated 0.75% | Lowers import costs; curbs inflation pass-through. |

| Annual Exchange Change | +9.4% | Up from +7.6% | Reverses 2024 depreciation; builds FX reserves. |

| Headline Inflation | 3.4% | Stable | Within targets; supports growth without overheating. |

| Food Inflation | 7.0% | Eased from 7.7% | NFRA stocks buffer supply risks; shilling aids imports. |

| Core Inflation | 2.2% | Up from 2.0% | Mild pressure from domestics; offset by FX stability. |

| Energy/Fuel Inflation | 3.7% | Down from 11.5% (2024) | Oil + shilling synergy reduces transport costs. |

| Interbank Rate | 6.45% | Eased from 6.48% | Effective policy transmission; ample liquidity. |

In summary, the shilling's September 2025 strength implies fortified macroeconomic stability, directly muting inflation risks and enabling growth-focused policies. This tandem—rooted in exports, interventions, and supply adequacy—positions Tanzania resiliently, though vigilance on commodity volatility and food chains is essential for 2026 continuity.

Tanzania’s current account deficit narrowed significantly to USD 2,117.6 million in the year ending June 2025, a 24.3% improvement from USD 2,797.7 million in June 2024. This USD 680.1 million reduction reflects robust growth in goods and services exports, especially from tourism and transport, which drove the net goods & services deficit down by 61.7% to USD 676.6 million. Service receipts rose to USD 7,110.4 million (+8.1%), led by travel (USD 3,934.5 million, +6.9%) and transport (USD 2,530.0 million, +9.8%), supported by a 10% increase in tourist arrivals. However, rising primary income outflows (USD 1,949.6 million, +17.9%) due to external debt servicing and a drop in remittances (USD 508.7 million, -18.1%) partially offset these gains. Meanwhile, foreign reserves stood at USD 5,307.7 million, covering 4.3 months of imports, above the national benchmark. Despite a surge in outbound travel spending (+51.4%), Tanzania’s external sector continues to show resilience, highlighting the importance of export diversification, tourism investment, and policy measures to manage foreign exchange outflows.

The current account balance reflects Tanzania’s trade in goods and services, primary income (e.g., interest and dividends), and secondary income (e.g., personal transfers and remittances) with the rest of the world. A deficit indicates that outflows exceed inflows, often financed by external borrowing or reserves.

Key Figures (Year Ending June 2025)

| Item | 2024 (USD Million) | 2025p (USD Million) | % Change |

| Current Account Balance | -2,797.7 | -2,117.6 | +24.3% |

| Goods & Services (Net) | -1,764.7 | -676.6 | +61.7% |

| Primary Income (Net) | -1,653.9 | -1,949.6 | -17.9% |

| Secondary Income (Net) | +620.9 | +508.7 | -18.1% |

Service receipts represent earnings from Tanzania’s service exports, including tourism (travel), transport, and other services (e.g., financial, insurance, ICT). These are critical to narrowing the current account deficit.

Total Service Receipts (Year Ending June 2025)

Category Breakdown

| Service Category | 2023 (USD Mn) | 2024 (USD Mn) | 2025p (USD Mn) | % Change (2024–2025) |

| Travel (Tourism) | 2,944.9 | 3,679.7 | 3,934.5 | +6.9% |

| Transport | 2,015.0 | 2,304.3 | 2,530.0 | +9.8% |

| Other Services | 440.9 | 594.6 | 645.9 | +8.6% |

Tourism Highlight

Service payments represent Tanzania’s expenditures on imported services, such as outbound travel, freight, and other services (e.g., financial, consulting).

Total Service Payments (Year Ending June 2025)

Category Breakdown

| Service Category | 2023 (USD Mn) | 2024 (USD Mn) | 2025p (USD Mn) | % Change (2024–2025) |

| Travel (Outbound) | 388.0 | 573.2 | 867.9 | +51.4% |

| Transport | 1,280.4 | 1,453.0 | 1,453.2 | ≈ 0% |

| Other Services | 691.1 | 691.1 | 573.2 | -17.1% |

| Indicator | 2024 | 2025p | Change |

| Current Account Deficit | -2.8 Bn USD | -2.1 Bn USD | ↓ 24.3% |

| Service Receipts (Total) | 6.58 Bn USD | 7.11 Bn USD | ↑ 8.1% |

| — Travel | 3.68 Bn USD | 3.93 Bn USD | ↑ 6.9% |

| — Transport | 2.30 Bn USD | 2.53 Bn USD | ↑ 9.8% |

| Service Payments (Total) | 2.36 Bn USD | 2.89 Bn USD | ↑ 22.7% |

| — Outbound Travel | 573 Mn USD | 867 Mn USD | ↑ 51.4% |