As the global economy moves toward 2030, it is increasingly shaped by the interaction between geoeconomic forces and the pace of technological transformation. The World Economic Forum’s December 2025 white paper, Four Futures for the New Economy, presents a structured framework that explores how differing levels of geopolitical stability and technology adoption could redefine global growth, trade, labor markets, and institutional trust over the next decade. Central to this analysis are disruptive technologies such as artificial intelligence, automation, and digital platforms, whose diffusion patterns will determine whether economies converge toward shared prosperity or fragment into rival spheres.

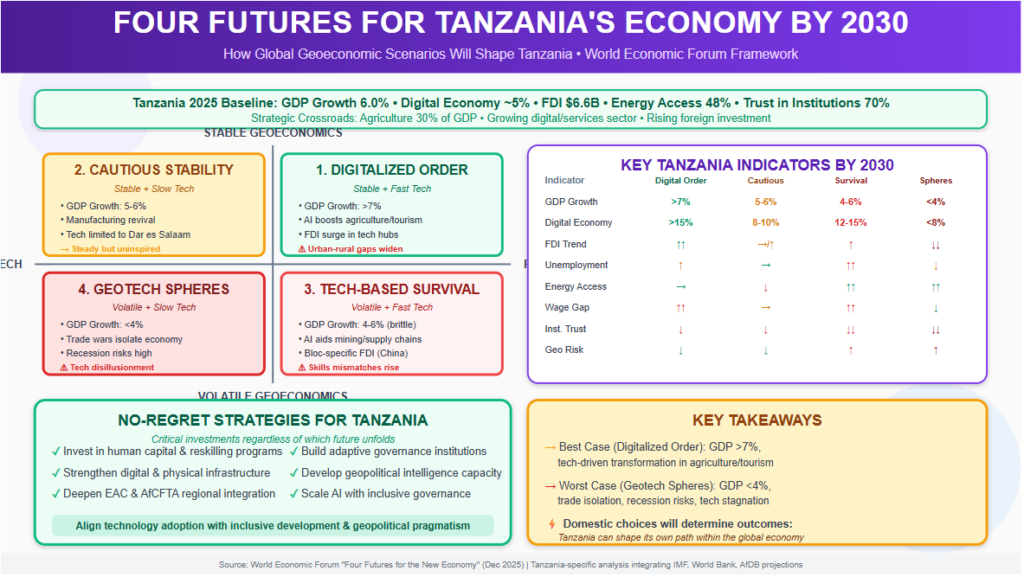

Globally, the paper identifies four plausible scenarios—Digitalized Order, Cautious Stability, Tech-based Survival, and Geotech Spheres—each reflecting a distinct combination of stable versus volatile geoeconomics and fast versus slow technology adoption. These scenarios project diverging trajectories for key indicators, including GDP growth, supply chain resilience, wage polarization, energy volatility, and public trust. With global GDP growth anchored around a modest 3.2% baseline in 2025, the report warns that without inclusive and well-governed technological integration, productivity gains may be offset by rising inequality and geopolitical risk.

For Tanzania, these global futures carry particularly significant implications. Entering 2025 with relatively strong macroeconomic fundamentals—GDP growth of about 6.0%, rising foreign direct investment, improving energy access, and comparatively high trust in public institutions—Tanzania stands at a strategic crossroads. The country’s economic structure, with agriculture contributing roughly 30% of GDP and a growing digital and services sector, makes it both resilient and vulnerable to global fragmentation. Rapid technology adoption could accelerate productivity in agriculture, mining, tourism, and public services, potentially lifting growth above 7%. Conversely, slow or uneven diffusion amid geopolitical shocks could expose Tanzania to trade disruptions, skills mismatches, and widening urban–rural divides.

By integrating the WEF’s global scenarios with Tanzania-specific data and development realities, this analysis provides a forward-looking lens for policymakers, investors, and businesses. It highlights not only how global transformations may shape Tanzania’s economic trajectory by 2030, but also how strategic choices made today—on technology governance, human capital, regional integration, and institutional resilience—will determine whether Tanzania emerges as a beneficiary or a casualty of the new global economic order. Read More: Risks to global growth with potentially disrupt the recovery or slow down economic expansion in '24

| Indicator | Baseline (2025) | Digitalized Order | Cautious Stability | Tech-based Survival | Geotech Spheres |

| Geopolitical risk index | 149.1 | ↓ | ↓ | ↑ | ↑ |

| Share of business tasks by technology (%) | 22% | ↑ | ↑ | ↑ | → |

| GDP growth (annual %) | 3.2% | ↑ | → | → | ↓ |

| Supply chain pressure index | -0.01 | ↓ | ↓ | ↑ | ↑ |

| US effective average tariff rate (%) | 17% | ↑ | →/↑ | ↑ | ↑ |

| Wage polarization (D9/D1 ratio) | 16.8 | ↑ | → | ↑ | ↓ |

| Energy price volatility (absolute monthly % change) | 3.7% | → | ↓ | ↑ | ↑ |

| Trust in media (% of population) | 52% | ↓ | ↓ | ↓ | ↓ |

Sources: WEF paper (e.g., IMF for GDP, ILO for wages).

Directional changes relative to 2025 baselines, adapted to local context (e.g., digital share proxies tech tasks, energy access adapts volatility, trust in institutions adapts media trust). Projections informed by IMF, World Bank, AfDB, and Tanzania-specific outlooks.

| Indicator | Baseline (2025) | Digitalized Order | Cautious Stability | Tech-based Survival | Geotech Spheres |

| GDP Growth (annual %) | 6.0% | ↑↑ (>7%, tech-driven exports) | → (5-6%, steady but uninspired) | → (brittle, 4-6% with shocks) | ↓↓ (<4%, recession risks) |

| Digital Economy Share (% of GDP) | ~5% | ↑↑ (>15%, AI in agriculture/tourism) | ↑ (limited, 8-10%) | ↑↑ (12-15%, survival tools) | → (stagnant, <8%) |

| Unemployment Rate (%) | ~2.8% (youth ~9%) | ↑ (disruption, but reskilling offsets) | → (stable, low tech impact) | ↑↑ (skills mismatches) | ↓ (localization creates jobs) |

| Foreign Direct Investment (FDI, $bn) | ~6.6 | ↑ (tech hubs attract) | →/↑ (stable aid flows) | ↑ (bloc-specific, e.g., China) | ↓↓ (isolationism deters) |

| Energy Access (% population) | ~48% | → (cooperative renewables) | ↓ (stalled green tech) | ↑↑ (volatile, but AI-optimized) | ↑↑ (spikes, resource nationalism) |

| Geopolitical Risk (e.g., EAC tensions) | Medium | ↓ | ↓ | ↑ | ↑ |

| Wage Polarization (urban/rural gap) | High | ↑↑ | → | ↑↑ | ↓ |

| Trust in Institutions (%) | ~70% | ↓ (misinformation risks) | ↓ | ↓↓ | ↓↓ |

Sources: IMF (GDP, unemployment), World Bank/AfDB (FDI, energy access), GSMA/UNCTAD estimates (digital share), Afrobarometer (trust), local reports (wage gaps, geopolitical risk subjective).

The WEF's global descriptions are adapted below with Tanzania-specific insights, focusing on how local factors (e.g., 30% GDP from agriculture, Belt and Road investments, National AI Strategy) interact with worldwide trends.

| Scenario | Top Risks (Global / Tanzania) | Top Opportunities (Global / Tanzania) | Strategy Considerations (Global / Tanzania) |

| Digitalized Order | Tech displacement; inequality / Displacement in agriculture; AI misuse in elections. | Productivity leapfrogging; digital hubs / Tourism/mining productivity; EAC interoperability. | Global strategies; scale innovation / Scale AI; reskilling via TAIC; governance. |

| Cautious Stability | Frontier-laggard inequality; weak dynamism / Urban-rural gaps; poor FDI returns. | Incremental innovation; emerging shifts / Manufacturing revival; stable aid. | Core R&D/M&A; dynamic markets / Infrastructure resilience; explore AfCFTA. |

| Tech-based Survival | Cyber risks; politicization / Infrastructure chokepoints; trade politicization. | Alliances; onshoring / Multi-sourcing; AI risk management. | Government alignment; localization / Regional strategies; local talent. |

| Geotech Spheres | Conflict escalation; innovation deserts / EAC conflicts; talent protectionism. | Backed sector growth; agility / Gas sector subsidies; non-aligned ties. | National alignment; partnerships / Domestic focus; cross-EAC alliances. |

WEF's global strategies, tailored for Tanzania:

This integration underscores Tanzania's potential to outpace global growth in optimistic scenarios while emphasizing resilience against volatility for inclusive development.

The four futures outlined by the World Economic Forum do not represent fixed destinies, but rather plausible pathways shaped by policy decisions, institutional capacity, and strategic coordination between the public and private sectors. For Tanzania, the analysis underscores a critical insight: while global forces will influence outcomes, domestic choices will ultimately determine how these forces translate into growth, inclusion, and resilience.

In optimistic scenarios such as Digitalized Order, Tanzania has the potential to outperform global averages by leveraging technology to modernize agriculture, expand digital services, and attract technology-driven investment. However, even in such favorable conditions, risks related to inequality, skills displacement, and governance failures remain significant. In more adverse futures—particularly Tech-based Survival and Geotech Spheres—the costs of geopolitical fragmentation, constrained technology diffusion, and declining trust could sharply limit growth and development gains.

The most important lesson across all scenarios is the value of “no-regret” strategies. Investing in human capital, strengthening digital and physical infrastructure, deepening regional integration through the EAC and AfCFTA, and building adaptive institutions can help Tanzania remain resilient regardless of which global future unfolds. By aligning technology adoption with inclusive development and geopolitical pragmatism, Tanzania can position itself not merely to withstand uncertainty, but to shape its own path within an increasingly complex global economy.